Feb 10, 2026

AI-Native Marketplaces: The New Breed Disrupting Jobs, Property & Cars

In Parts 1-3, we examined how AI threatens traditional marketplaces through discovery disintermediation, how LLMs are positioning themselves as meta-aggregators, and how entirely new marketplace categories are emerging that couldn't exist without AI. Today, we zoom into three of the largest marketplace verticals, recruitment, real estate, and automotive, to examine which AI-native challengers are gaining traction and where genuine disruption is occurring

These platforms are born from AI capabilities, solving problems that only became solvable with foundation models. The disruption intensity varies dramatically across verticals.

Recruitment

Traditional job boards and recruiting workflows are information-intensive, labor-heavy, and plagued by inefficiency. Recruitment is arguably the vertical where AI-native marketplaces have advanced furthest and pose the most credible threat to incumbents. Traditional job boards are passive listing platforms, they aggregate supply (job postings) and demand (candidates). However, matching is often crude, with keyword searches, manual CV screening, and human judgment the norm. The result is a process that is slow, and time consuming for candidates and recruiters alike. LinkedIn, Indeed, and the major generalist job boards have layered AI onto this model, but their core architecture remains search-and-apply.

AI excels precisely where human recruiters struggle: processing thousands of candidates simultaneously, maintaining context across fragmented data sources, and conducting initial screening at scale without fatigue and with minimal bias. AI native platforms start with AI-driven sourcing, screening, or matching and build the marketplace around those capabilities.

Continuous Candidate Evaluation Platforms

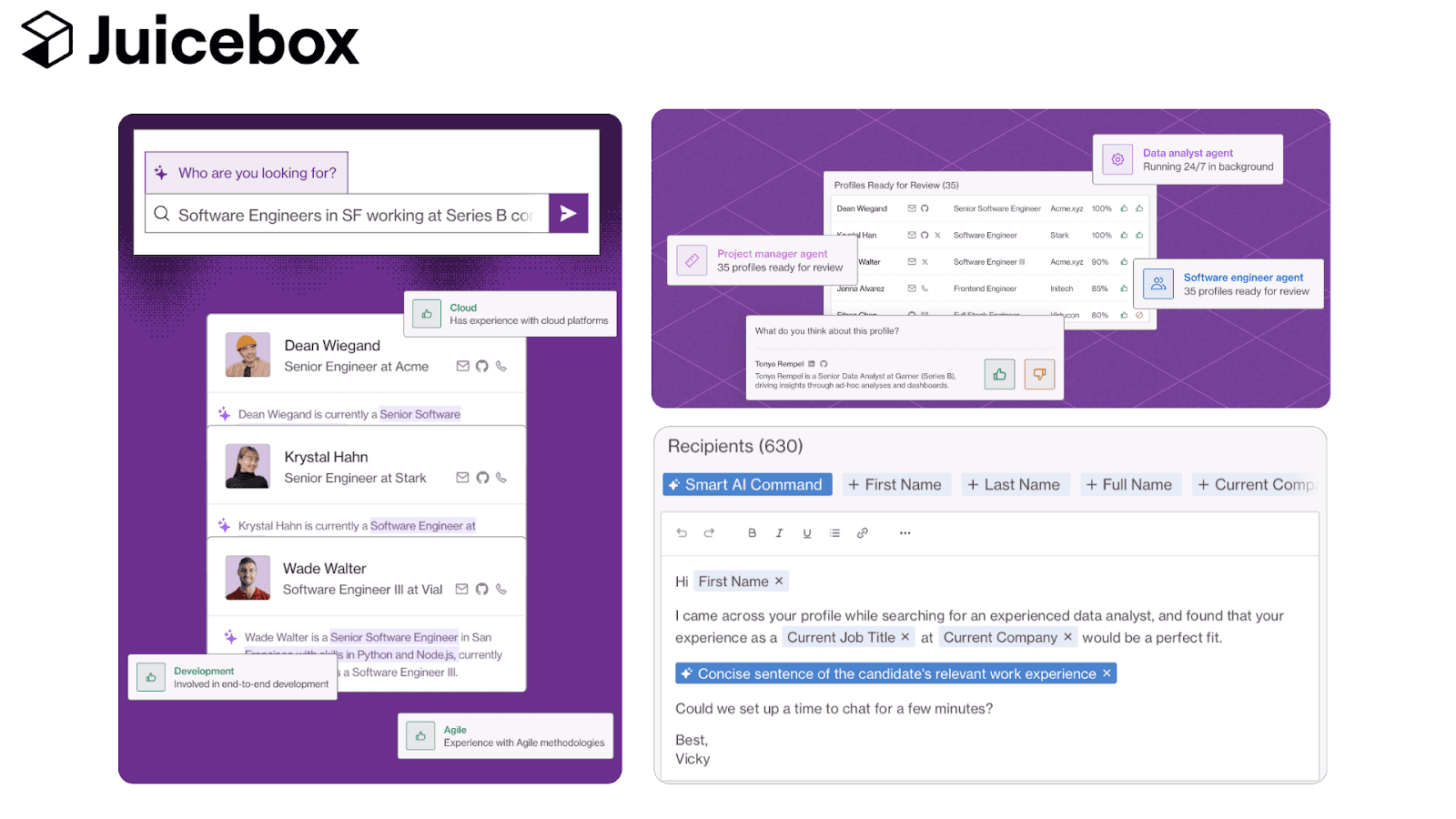

JuiceBox ($180M investors include: Sequoia Capital (lead), NFDG, Coatue, YCombinator) replaces the traditional "post-and-pray" application model with continuous, automated candidate evaluation. Instead of waiting for people to apply, JuiceBox runs background interviews, skills assessments, and preference matching across a broad pool of active and passive candidates. The result is a constantly refreshed map of job-ready talent where employers are matched to candidates who are already screened and ranked.

This inverts the traditional funnel. On LinkedIn or Indeed, employers post a role and filter through hundreds of unqualified applications. On JuiceBox, candidates are pre-qualified before a role even exists, and matching happens against intent signals rather than keywords. The marketplace creates liquidity not through supply aggregation but through AI doing the interviewing and qualification work that was economically impossible with human recruiters alone.

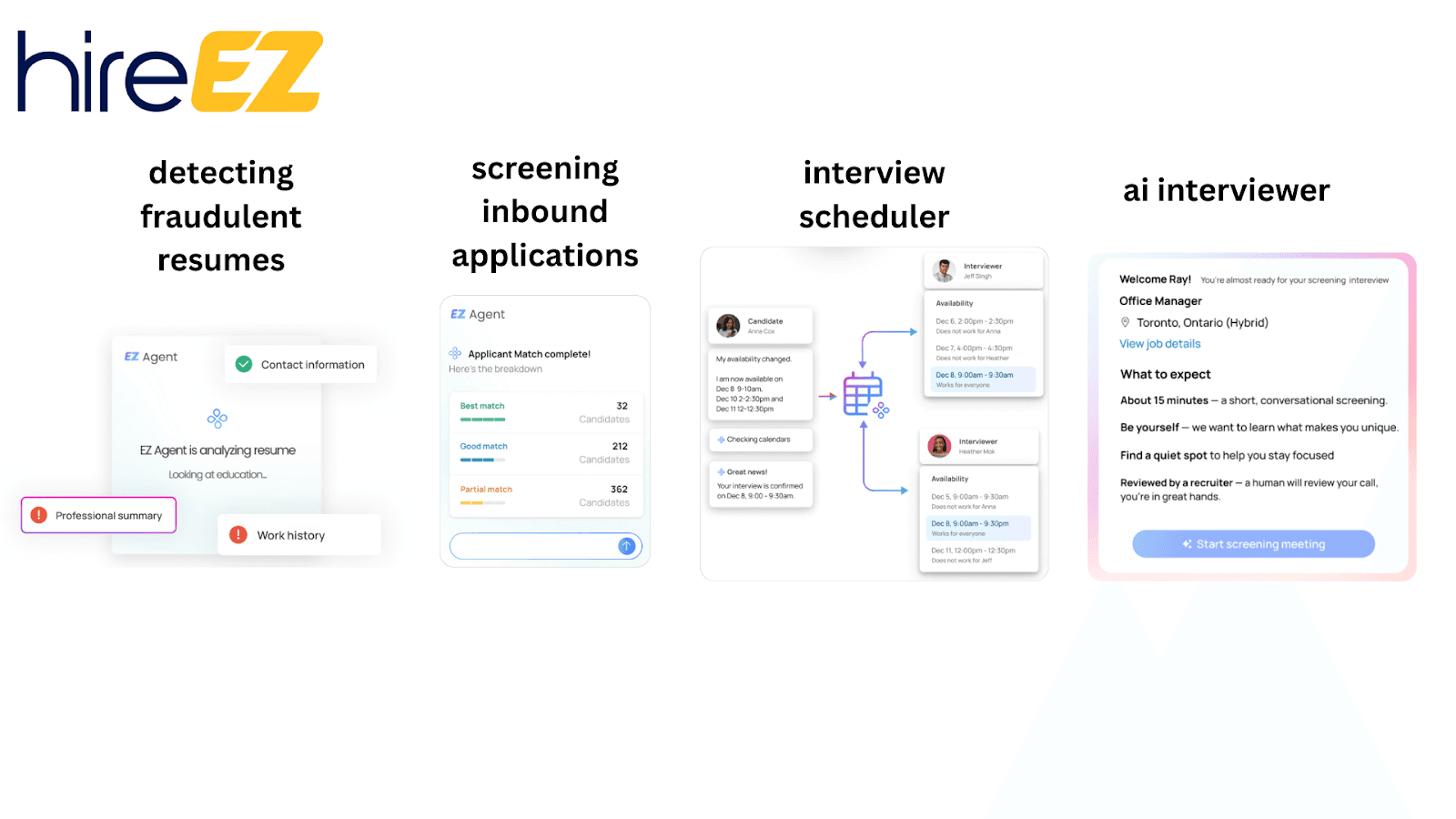

HireEz (valued $200M+; investors include Northern Light Venture Capital, Conductive Ventures, Oceanpine Capital) goes one step further by unifying sourcing, screening, engagement, and rediscovery under an agentic AI layer. Instead of treating recruiting as a sequence of manual steps across job boards, ATSs, and outreach tools, HireEz scans the open web and internal databases simultaneously, ranks candidates by fit, and automates engagement, screening, and interview scheduling. The platform expands the talent pool beyond active applicants to include previously overlooked and dormant candidates, while AI handles the heavy lifting of evaluation and follow-up.

Traditional ATS systems are passive databases. HireEz is an active discovery engine that continuously evaluates the entire candidate graph, not just inbound applicants.

Jack & Jill (seed round of $20M led by Creandum), which we explored in Part 3, takes a different approach through conversational voice interviews on both sides. "Jack" conducts 20-minute voice conversations with job seekers to understand career ambitions beyond what a resume captures, then searches tens of thousands of listings hourly with personalized recommendations. "Jill" conducts voice briefings with hiring managers to grasp role nuances, then autonomously sources, screens, and conducts initial interviews before making direct email introductions between matched candidates and employers. The disruption is in replacing keyword-matching with conversational understanding, extracting signals from dialogue rather than reducing candidates to set of searchable tags.

Freelancer Platforms

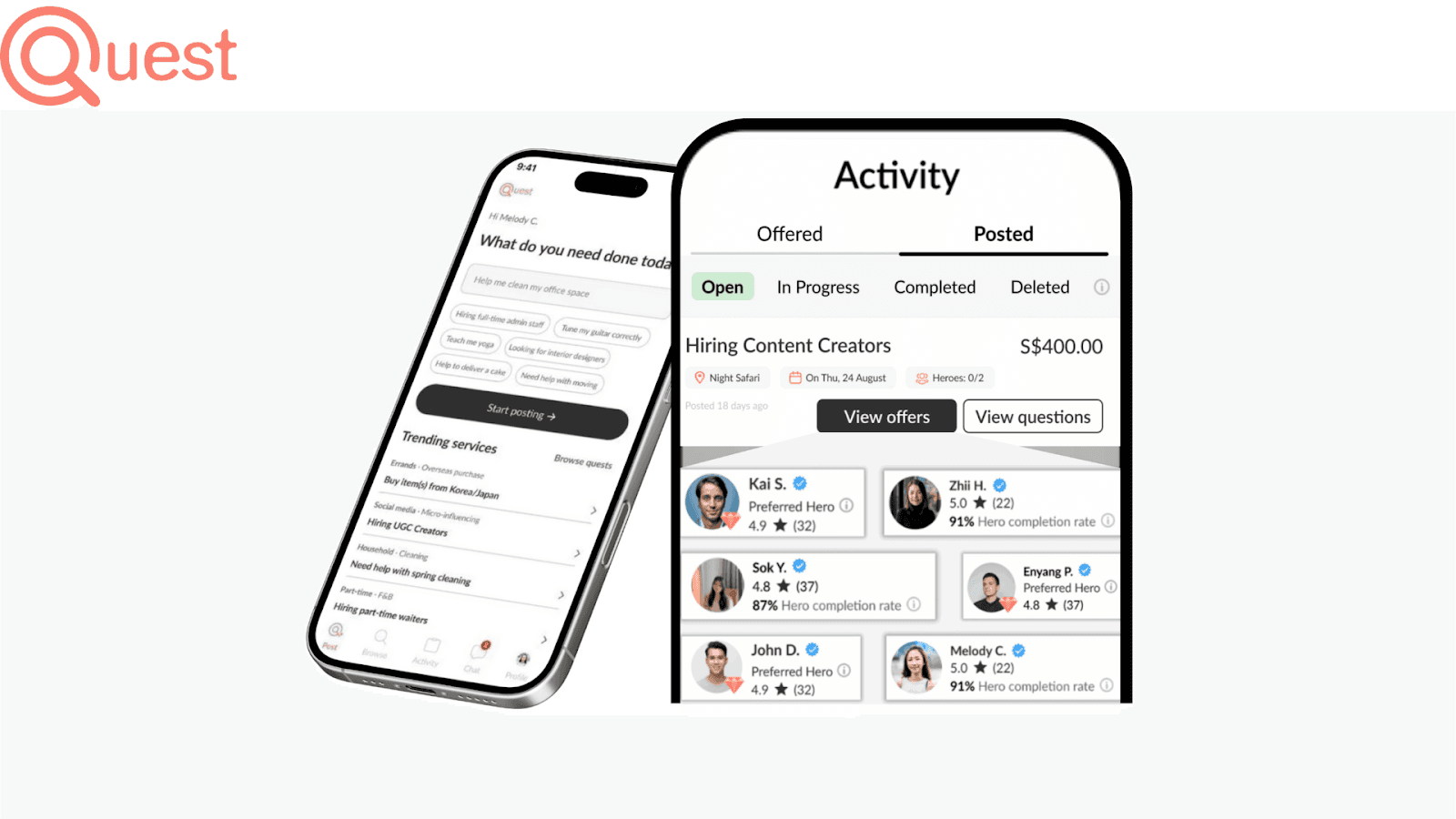

Quest (seed round led by Goodwater Capital) is an AI-orchestrated services marketplace that replaces browse-and-bid gig platforms Instead of users searching categories or freelancers, tasks are described in natural language and an AI concierge scopes the work, prices it, and routes it to the most relevant worker from a verified supply pool. The platform manages matching, coordination, and completion end-to-end, turning fragmented gig demand into structured, executable jobs.

This model couldn't exist pre-AI because scoping work from unstructured descriptions, estimating accurate pricing, and matching supply in real-time requires semantic understanding and contextual reasoning at scale. Traditional platforms like Upwork or Fiverr require users to write detailed briefs, evaluate proposals, and negotiate scope. Quest's AI does this work automatically, compressing what used to be a multi-day process into minutes.

Job Verticals

Incredible Health (valued ~$1.65B; investors: Base10 Partners, Kaiser Permanente, a16z) illustrates how AI enables highly specialized, vertical-specific marketplaces previously uneconomic to operate. Nurse hiring is credential-heavy, specialty-driven, and highly regulated, making generalist job boards and staffing agencies inefficient and expensive.

Incredible Health uses AI to continuously verify credentials, understand specialty-level requirements, and match nurses to permanent roles based on clinical experience, location, and preferences. Hospitals apply directly to pre-qualified nurses, reversing the traditional application flow. AI automates outreach, screening, and interview coordination, handling the regulatory complexity that made this market too expensive to serve profitably through traditional means.

The platform has connected 1.5 million healthcare workers with 1,500 employers in a market where traditional matching was too slow for a workforce that turns over rapidly. This represents a category that couldn't exist without AI making the economics viable.

Why Recruitment is Most Disrupted

Several structural factors make recruitment particularly vulnerable to AI-native disruption:

Information-intensive workflows: Recruiting is fundamentally about processing information (resumes, skills, experience, preferences) and matching it to requirements. AI excels at this.

High manual screening costs: Traditional recruiting spends 80% of time on initial screening that eliminates obviously unqualified candidates. AI can significantly reduce much of this initial screening burden.

Passive candidate unlock: The best candidates aren't actively looking. AI can continuously evaluate and engage passive candidates at scale, dramatically expanding the effective talent pool.

Low regulatory barriers: Recruiting has minimal licensing requirements, making it easier for new models to gain traction.

Broken incumbents: Traditional job boards (Monster, Indeed) and even LinkedIn often struggle to solve the fundamental matching problem, leaving the door open for AI-native alternatives.

Real Estate

AI-native platforms excel at translating lifestyle intent into property matches, understanding "close to good schools and parks" or "walkable neighborhood with cafes" in ways traditional filter-based search cannot. Some are also unlocking new supply by challenging commission-based business models, expanding the transaction pool beyond what incumbents capture.

AI-First Consumer Portals & Search

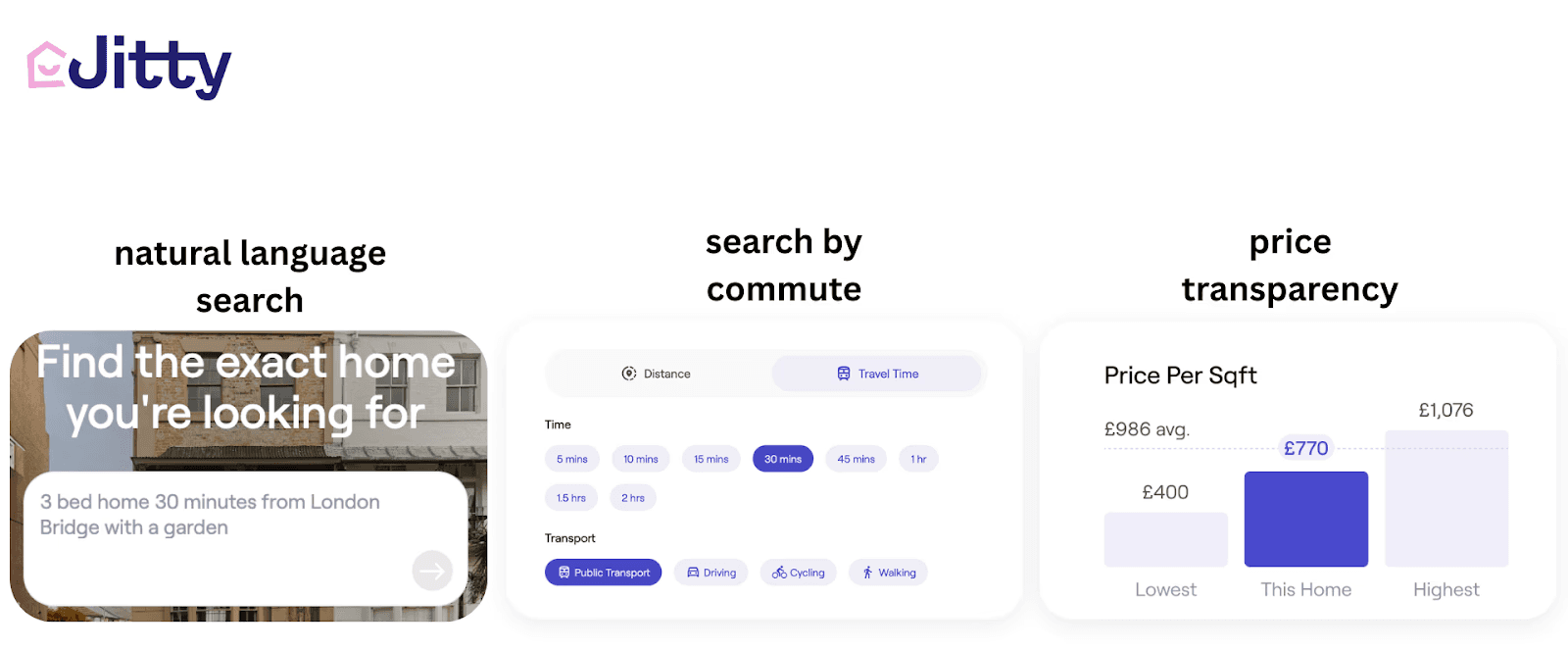

Jitty (backed by Goodwater Capital and REA Group) is an AI-native property discovery marketplace that replaces rigid filters with natural-language search and free supply ingestion. Buyers search using descriptive intent (style, feel, features, commute logic) and AI parses listings, photos, and floor plans to surface homes that match how people actually think. On the supply side, agents list for free, and relevance is determined by context-based fit rather than paid placement.

This creates a demand-led marketplace where liquidity comes from better matching, not for having the most listings.

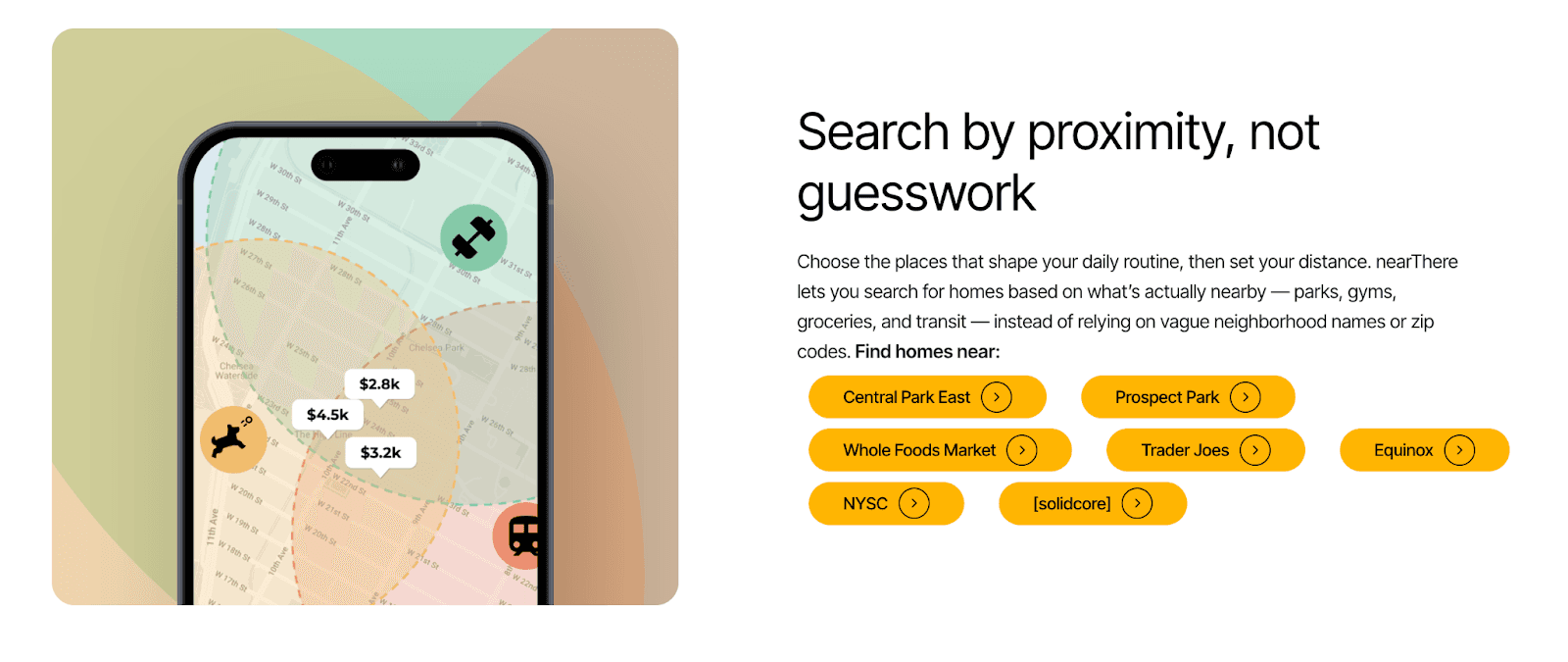

NearThere reimagines property search as a proximity-driven matching marketplace rather than a listings database. Traditional portals optimize for filters like price and bedrooms. NearThere flips this by letting users search around the places that matter to them (parks, gyms, cafés, schools) and uses AI to surface homes within suitable distances.

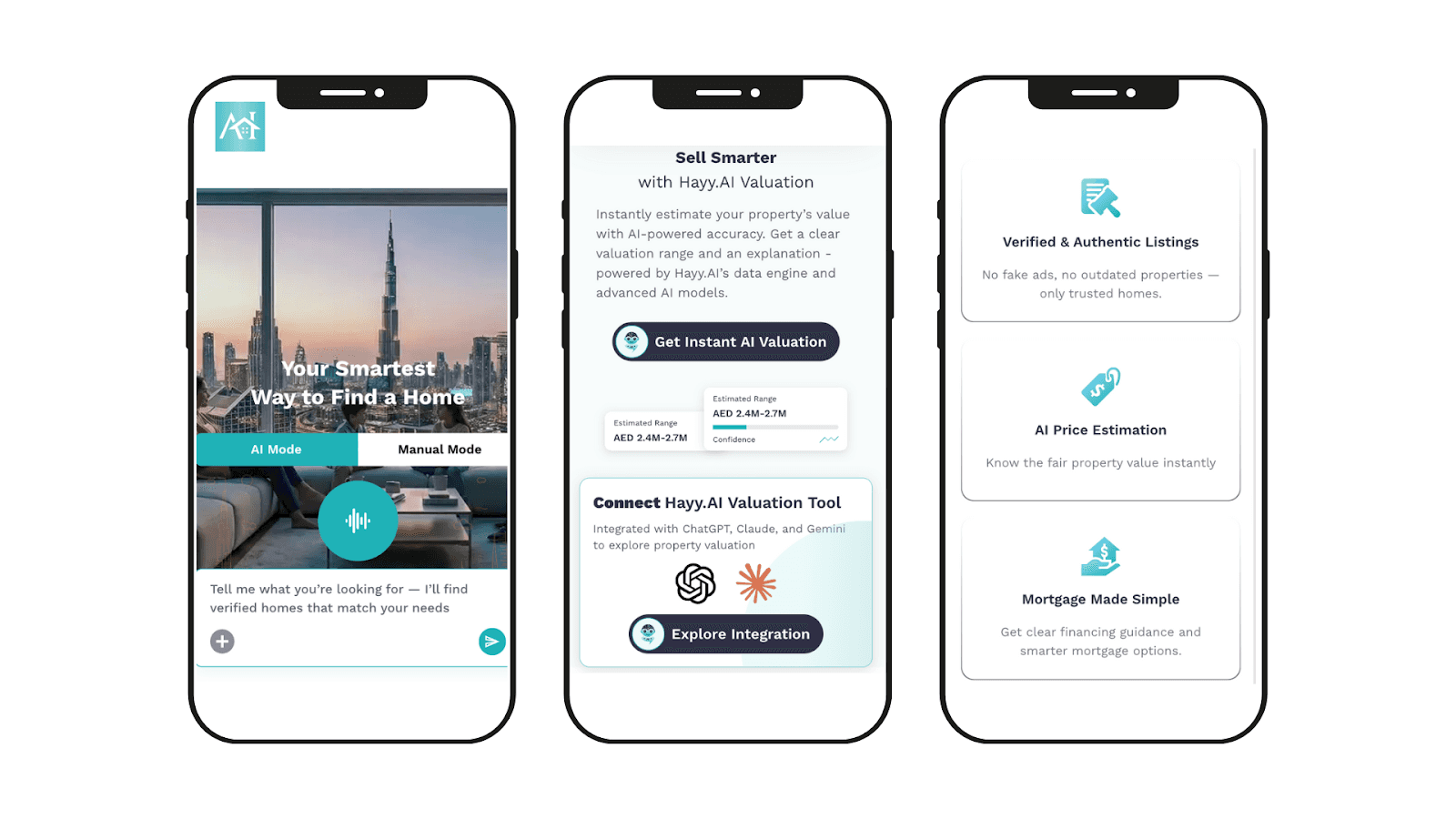

Hayy.ai has launched in Dubai, with a conversational, AI-driven marketplace. Instead of manually filtering properties and juggling separate tools for valuation, and market research, users interact with an AI assistant that understands intent through chat, voice, and image views to surface relevant homes, price insights, and investment signals in real time, thereby providing personalized recommendations and predictive guidance.

On the supply side, agents and developers plug into a unified platform that automates lead scoring, follow-up, and market analytics.

AI-Assisted FSBO & Seller-Led Transactions

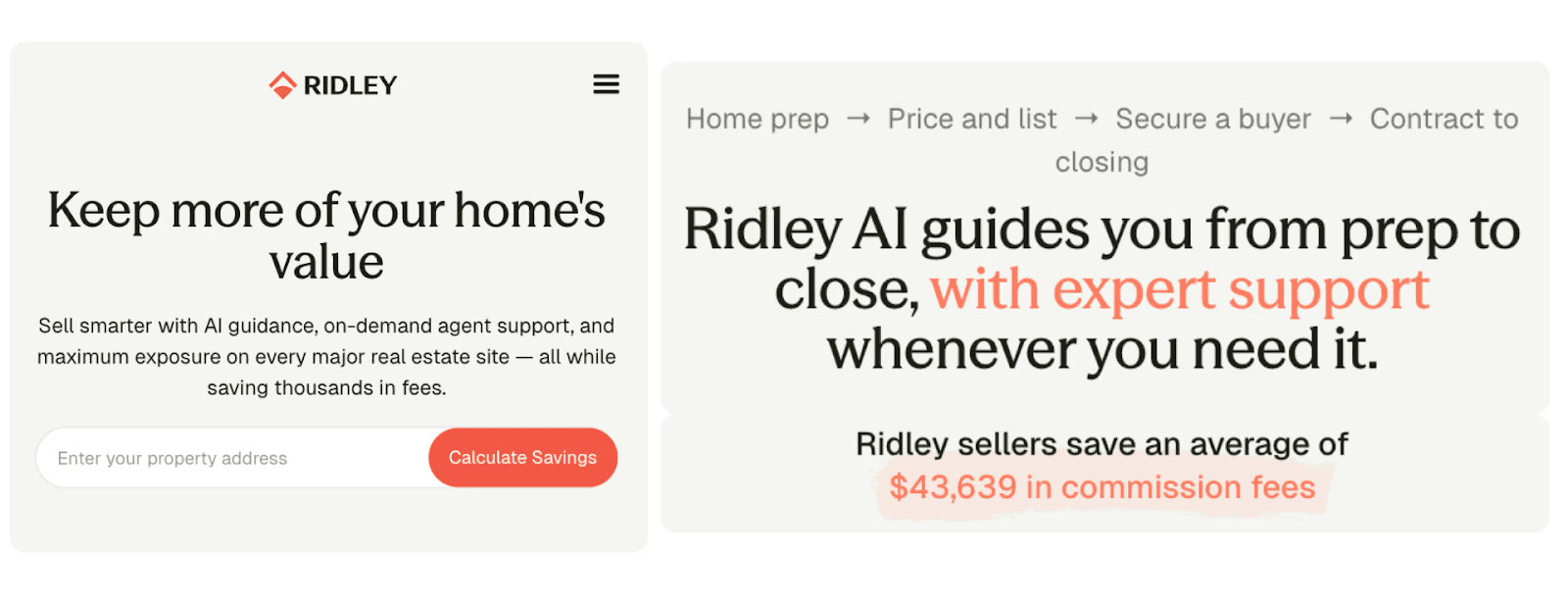

Ridley turns for-sale-by-owner (FSBO) into a guided, AI-assisted transaction marketplace. Instead of relying on agents or fragmented FSBO tools, homeowners use Ridley to price their home, prepare the listing, syndicate it across major portals, evaluate offers, and navigate contracts with AI support and optional expert help.

Software and AI replace much of the coordination, pricing logic, and paperwork traditionally bundled into agent commissions (typically 5-6% in the US), while sellers retain control and more equity.

Beycome (pre-seed raised from Neer Venture Partners and Kima Ventures), operates similarly, unbundling agent commissions into automated workflows. Beycome helps homeowners list on MLS and major portals for a flat fee, while the platform handles syndication, pricing guidance, documentation, and optional closing services. This creates a lower-cost, higher-liquidity marketplace for sellers who might otherwise stay off-market due to high brokerage fees.

These platforms represent genuine value creation by reducing transaction costs, but they're not AI-native in the same way JuiceBox is. The AI assists with pricing and document preparation, but the core value proposition is process automation and commission arbitrage, not new matching capabilities that were impossible before 2024.

Data-Driven Agent Matching

TrueParity turns real-estate agent selection into a data-driven matching marketplace rather than a referral or advertising game. Instead of choosing agents based on brand visibility or word-of-mouth, homeowners are matched with agents who have demonstrably performed best on similar homes in the same neighborhood, using AI to analyze millions of historical transactions.

Agents compete on outcomes, not ad spend, and sellers receive transparent comparisons on pricing, speed, and negotiation effectiveness.

Flexible Workspace

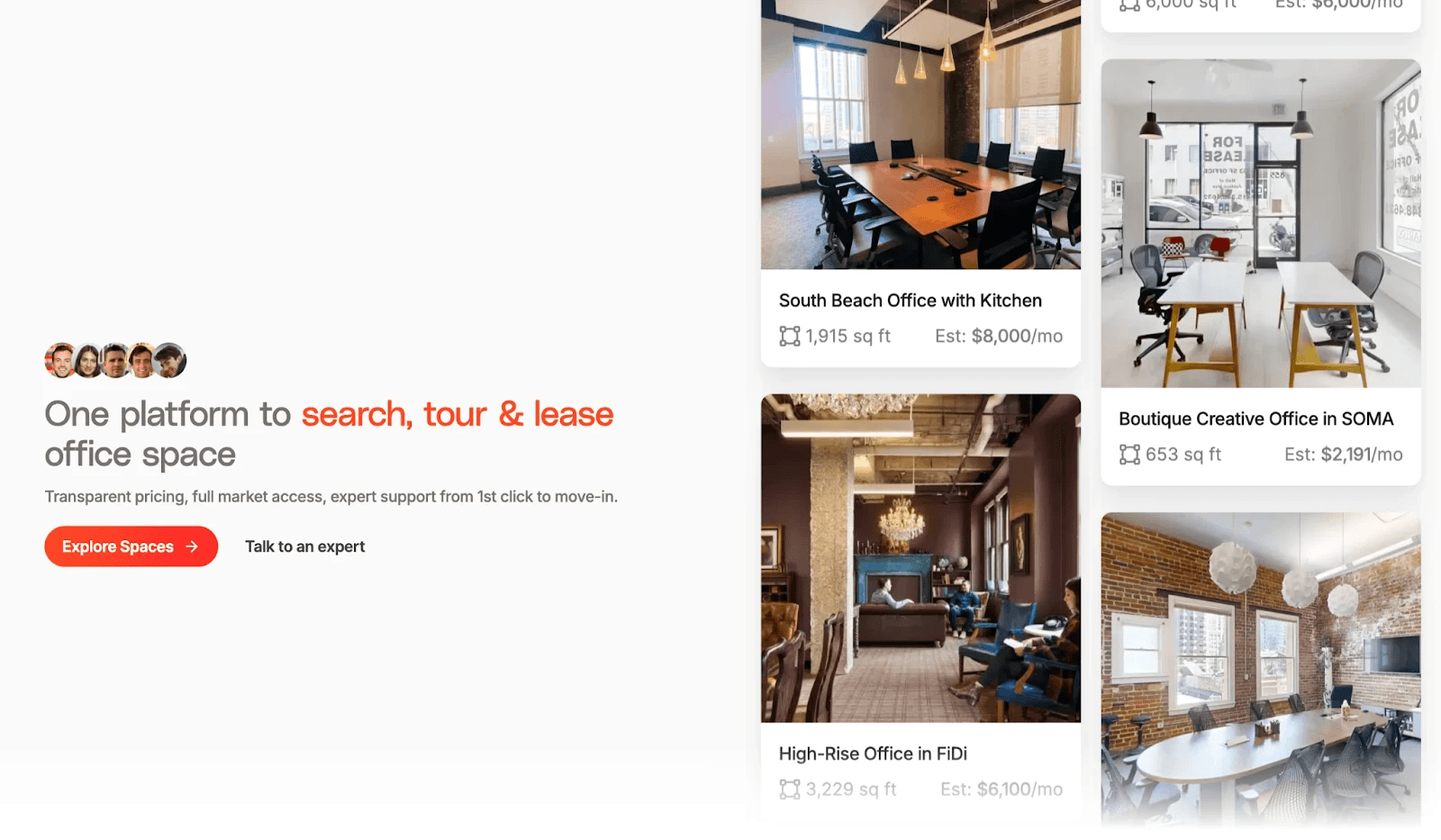

Tandem.space (YC S24 batch, other investors include Pioneer Fund and Soma Capital) transforms office leasing from a broker-driven, months-long process into an on-demand marketplace for flexible workspace. Instead of static listings and manual negotiations, landlords list offices for free while AI helps qualify demand, manage tours, and automate contracts, insurance, and payments.

Tenants can discover, book, and lease offices online with transparent pricing and short commitments, turning excess office capacity into liquid supply. This model unlocks a market that traditional brokers couldn't serve economically, as the transaction sizes and lease durations were too small to justify manual effort.

This is a genuine example of AI making an uneconomic market viable, similar to what we saw in recruiting. The defensibility comes from supply aggregation and workflow automation rather than discovery innovation.

Why Property is Moderately Disrupted

Based on what we’re seeing so far, property appears to sit between recruitment and automotive on the AI-disruption spectrum for several structural reasons:

Inventory still drives network effects: Despite better matching algorithms, property marketplaces fundamentally compete on breadth of listings. Buyers want to see all available options, not just the "best" match, to feel confident they haven't missed something better. Platforms like Zillow, Rightmove, and Immoscout24 can add AI features faster than AI-native startups can aggregate comparable supply.

High-involvement decision: Buying or renting a home is one of the highest-stakes financial decisions most people make. Users want to see properties in person, verify conditions, and feel confident they've explored all options before committing. AI can shortlist effectively, but buyers still want breadth of choice as reassurance. A curated list of 5 "perfect" matches feels superficial compared to browsing 50 options, even if 45 are objectively worse fits.

Emotional and subjective criteria: "Does this feel like home?" is not a question AI can answer reliably upfront. Buyers often know what they want when they see it, but struggle to articulate it in ways AI can process before viewing. The "vibe" of a neighborhood, the light quality in a room, or the feeling of a space are discovered through experience, not extracted from listings.

That said, AI-native platforms are genuinely improving specific parts of the property journey:

Discovery optimization: Natural language search and proximity matching help buyers articulate lifestyle preferences they couldn't easily express through traditional filters.

Pricing transparency: AI-driven valuation models surface pricing insights that reduce information asymmetry between buyers and sellers

Process automation: Process automation around document preparation, tour scheduling, and lead qualification removes friction from the mid-funnel experience.

Automotive

Of the three verticals, automotive so far appear to have witnessed the least traction from truly AI-native marketplace disruptors. Discovery is more straightforward than jobs and homes given the standardized attributes (make, model, year, mileage), and incumbents have already reduced much of the historical friction by bundling trade-ins, financing, warranties, and even home delivery into a single, integrated purchase flow. As a result, much of the value in car buying appears to sit outside pure matching, making the value-add from AI native platforms much more complex to bring about.

AI's impact in automotive marketplaces so far appears largely incremental: optimizing pricing, workflows, automated trust & verification, and post-purchase outcomes. These are valuable operational improvements that make existing marketplaces more efficient, but they don't yet fundamentally restructure how supply and demand connect.

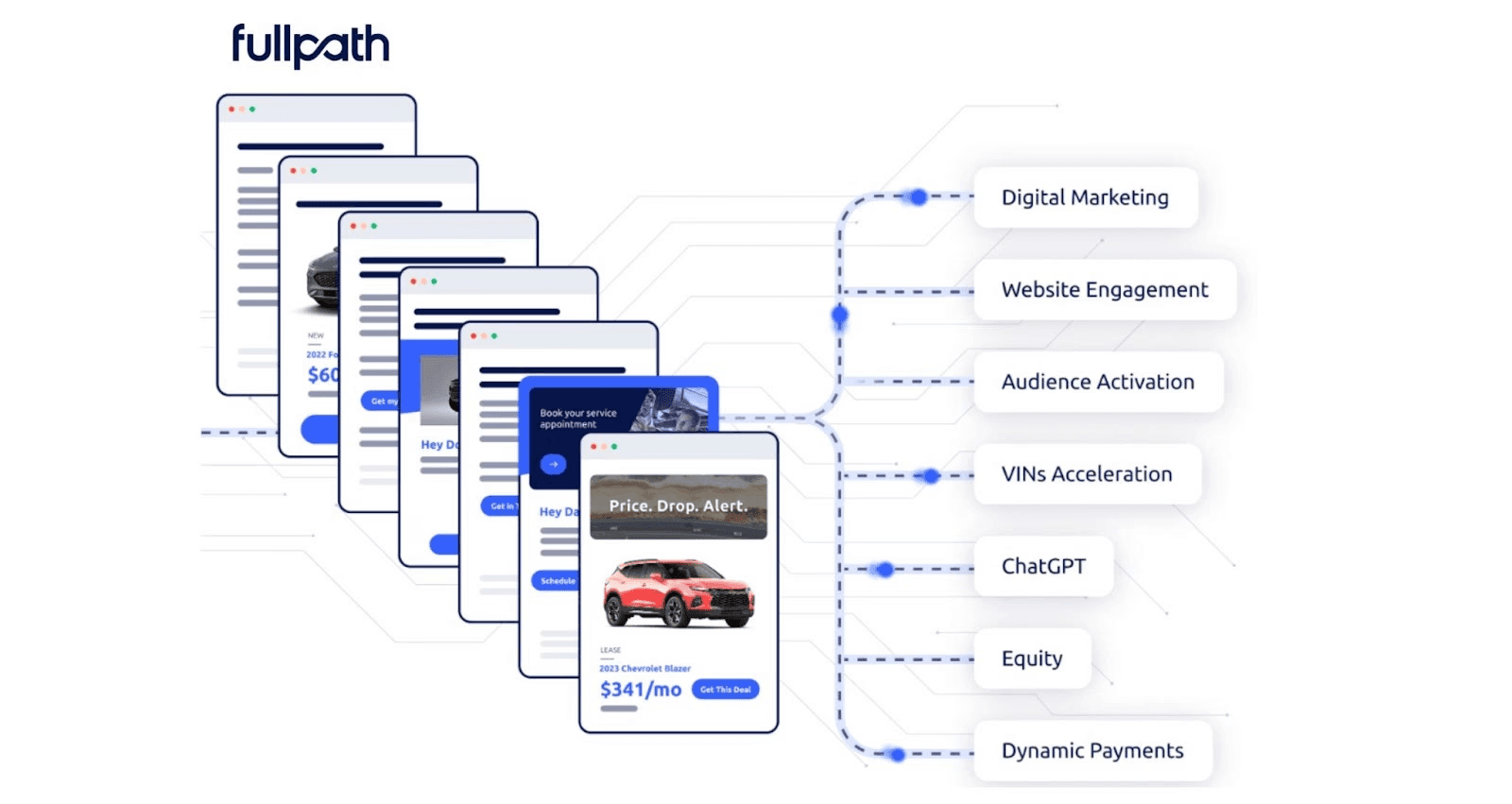

We are however starting to see AI startups emerge like Fullpath that may reduce dealer dependence on traditional marketplaces. The platform uses AI to personalize engagement, replacing core marketplace functions like lead generation, intent detection, and buyer qualification. By building "micro-marketplaces" from their own customer data, dealers could shift spend, at least in part, from marketplace listing fees to owned-channel optimization.

However, Fullpath doesn't fully eliminate marketplace dependence. Discovery still happens on traditional marketplaces for new-to-market buyers, inventory aggregation remains valuable for comparison shopping, and new customer acquisition still requires marketplace presence.

AI-assisted vehicle upgrades

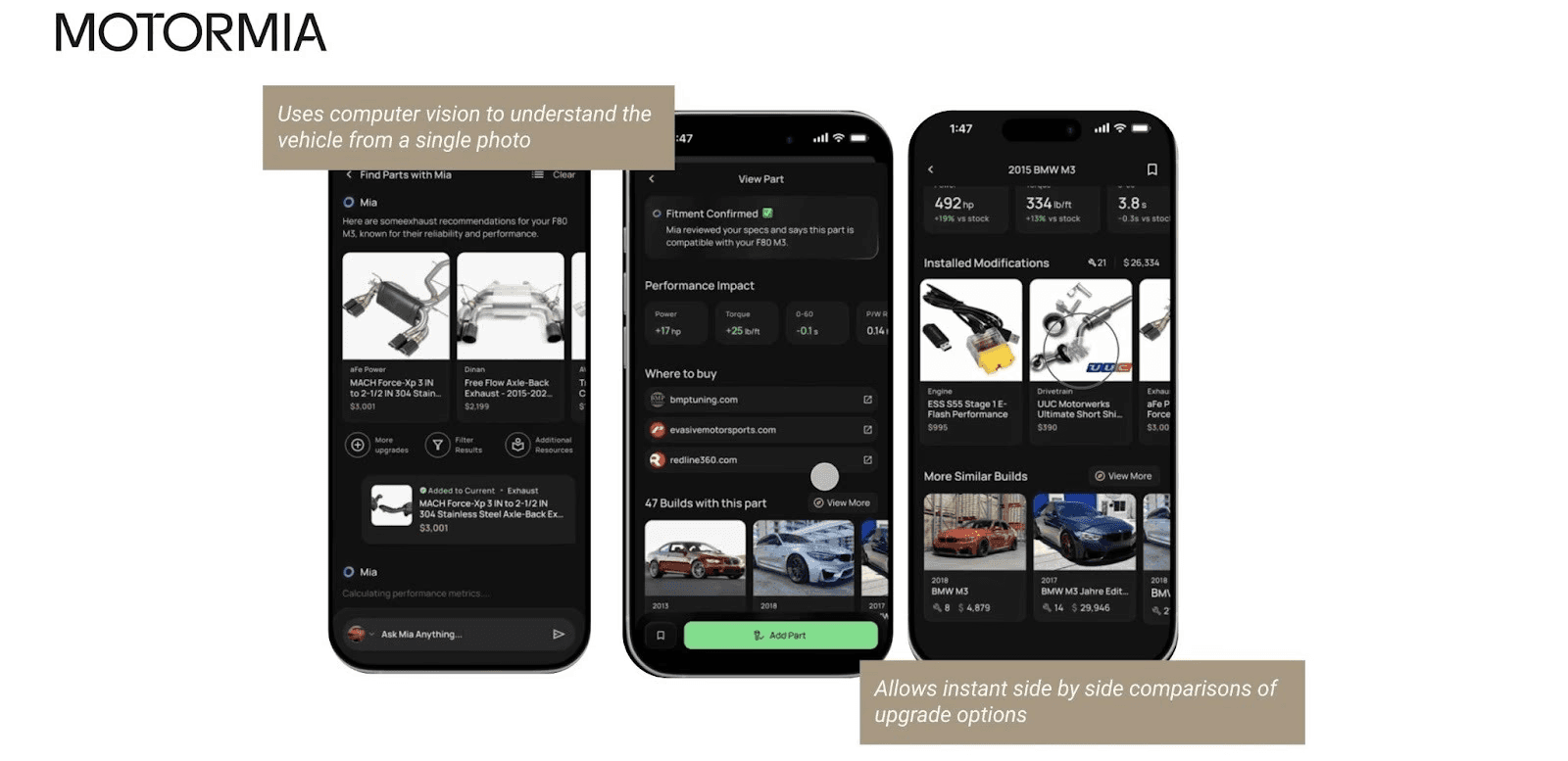

Motormia (seed funded valued at ~$60M, investors include Alumni Ventures and Deftly Ventures) is an AI-powered vehicle customization platform that helps car, truck, and bike enthusiasts find compatible performance parts and plan their builds using personalized recommendations. Instead of browsing catalogues and forums, users upload vehicle details and describe their goals, and an AI assistant acts as a virtual mechanic, recommending compatible parts, estimating performance gains, and generating visual build previews based on similar vehicles and community data.

The marketplace shifts from listing visibility to relevance: suppliers compete to match a specific build intent rather than generic keywords.

This is genuinely innovative for enthusiast markets, but it's a niche use case. Most car buyers aren't building custom setups; they're buying stock vehicles from dealers or certified pre-owned platforms. The TAM is limited to enthusiasts, which is a profitable but small segment.

We see several structural factors that may be holding back AI-native disruption in automotive marketplaces, at least for now, as a result of which cars appear more resistant to AI-led re-architecting than jobs or property:

Mature category: The supply (new and used cars) is already digitized and listed on existing marketplaces such as AutoTrader or Carsales.com.au in mature markets. Dealers have little "hidden inventory" that AI can unlock and individual sellers are often reluctant to sell cars peer to peer (hassle, safety concerns, financing complexity); they trade-in when they buy, sell to a dealer or sell via a marketplace auction

Low discovery complexity: Unlike property, where discovery is more complex (lifestyle fit, neighborhood character, nearby amenities, future development plans, etc), a car is a standardized product with simple search criteria (make, model, year, mileage, price). Search is relatively straightforward.

Incumbent strength: Transactional Platforms like Carvana, Clutch, CarMax, etc. already offer transparent pricing, online purchasing, and home delivery. The incremental improvement from an AI native incumbent is marginal compared to what these platforms already provide, and the capital needs to match or beat their scale are counted in billions of USD. The moat comes from demand aggregation, rather than technology capability; sellers and dealers go where the demand is.

Despite limited AI-native marketplace disruption so far, we are beginning to see a new wave of AI startups building solutions to meaningfully transform the automotive marketplace experience. Rather than re-architecting supply and demand, these efforts focus on improving efficiency, trust, and coordination across the transaction. Emerging applications include autonomous transaction agents that negotiate and execute purchases, intelligent vehicle valuation and pricing, automated trust and verification through AI-powered inspections, end-to-end transaction orchestration, supply-side optimization for dealers, and fraud detection systems. In Part 5, we'll explore which startups are building these capabilities and how incumbent marketplaces are deploying them to strengthen their competitive positions.

Disruption Intensity Varies by Market

Our review suggests that so far the disruption potential from AI-native start ups is not uniform across verticals.

In recruitment, where network effects have been weakest outside of LinkedIn and Indeed, AI-native platforms are genuinely re-architecting how supply and demand meet. The shift from passive listings to continuous, AI-driven evaluation represents a structural change to the marketplace model itself. While most job boards remain stuck in a pay per post or pay per click mode, AI native challengers are charging their clients per outcome (LinkedIn and Indeed are following suit). We expect AI-native platforms to put traditional job boards under intense pressure over the next few years.

In real estate and automotive, we're seeing most of the innovation at the UI/UX level. But so far, AI-native platforms are enhancing the discovery experience without fundamentally restructuring marketplace power dynamics. While natural language search and proximity matching improve initial shortlisting, the core value driver remains comprehensive inventory coverage combined with a high volume, high engagement user base. Incumbents in both these segments (Zillow/Rightmove/AutoTrader/Mobile.de) retain structural advantages: their listing aggregation creates network effects that AI cannot yet replicate, and they can deploy AI features defensively faster than challengers can build comparable supply.

The larger threat still comes from LLMs evolving into meta-aggregators, with their role as universal discovery layers sitting above individual marketplaces. A buyer could ask ChatGPT to "compare prices for a 2022 Honda Civic EX with under 30,000 miles across Autotrader US, Carvana, and local dealers within 50 miles," and the LLM would aggregate listings, synthesize pricing, highlight trade-offs, and present a shortlist. For recruitment, as we explored in Part 2, ChatGPT's agent mode can go further: searching for senior backend engineers across LinkedIn, Indeed, and niche job boards, screening candidates against specified criteria, and even initiating outreach.

This points to a future where even incumbents with comprehensive inventory and strong network effects potentially face traffic disintermediation. In Part 5 of this series, we'll examine how existing marketplaces can harness AI to strengthen moats, deepen engagement, and build defensible advantages in an era where discovery is becoming conversational and distributed.

This is Part 4 of our five-part series on AI and Marketplaces. Read Part 1: Strengthening Marketplace Moats | Read Part 2: LLMs and AI Agents Challenging Marketplaces | Read Part 3: AI is Creating New Marketplaces