Feb 4, 2026

AI is creating new marketplaces

In Parts 1 and 2 of this series, we examined how AI threatens traditional marketplace models by disintermediating discovery, and how LLMs are positioning themselves as meta-aggregators.

Today we want to share a parallel story that is unfolding: entirely new marketplace categories are emerging that couldn't exist without AI at their core. In these ecosystems, supply is often generated on-demand, and the frequency and precision of matching far surpass the capabilities of traditional systems. And in some instances, AI agents themselves evolve into active economic participants within these new markets.

Marketplaces for AI Agents

The most natural starting point is marketplaces for AI agents. Instead of building custom capabilities in-house, companies can access, deploy, and adapt pre-built agents designed for specific tasks and workflows.

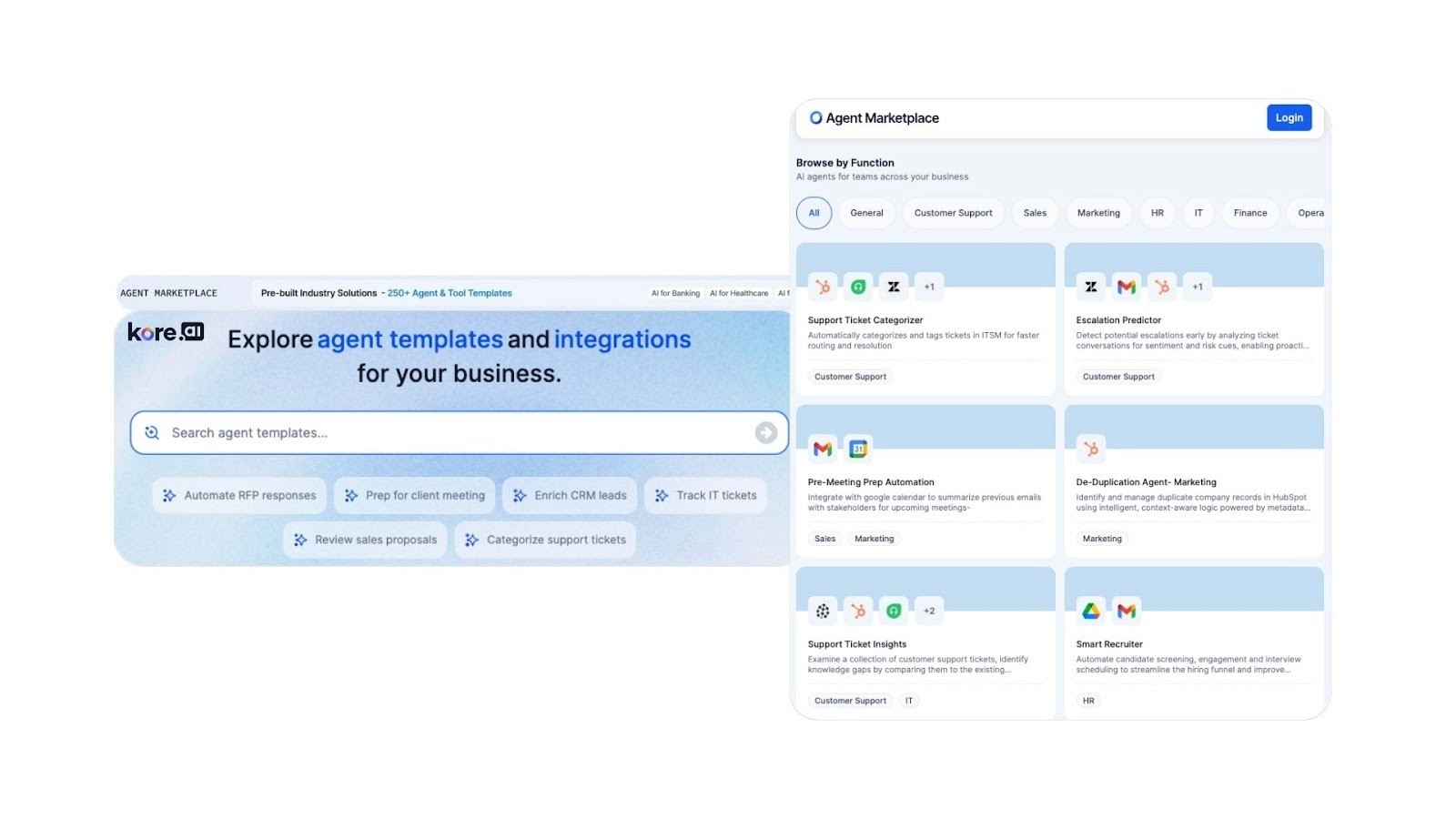

Kore.ai (valued at $1B+) offers 200+ enterprise-grade templates that enable businesses to build and deploy AI agents up to10x faster than building from scratch. The platform spans customer service, HR, IT, sales, and industry-specific use cases across banking, healthcare, retail, and telecommunications. Kore.ai provides configurable templates that enterprises can customize and deploy within their existing infrastructure, sitting between pure build-it-yourself and fully managed agent subscriptions.

Similarly, Enso is an AI agent marketplace for SMBs. Small businesses subscribe to unlimited access to 300+ curated AI agents, spanning social media management, content creation, HR, legal services, and growth operations. The agents act as virtual employees that automate marketing, sales, and admin workflows. Through a partnership with LangChain, the marketplace continues to expand with new agents from AI developers, creating an ecosystem where builders can reach the SMB market and businesses can access capabilities.

AI-Generated digital products supplied on-demand

Here AI generates the supply side, on-demand. Instead of simply linking pre-existing buyers and sellers, AI computationally generates exactly what the buyer wants, the moment he/she, or an AI agent wants it.

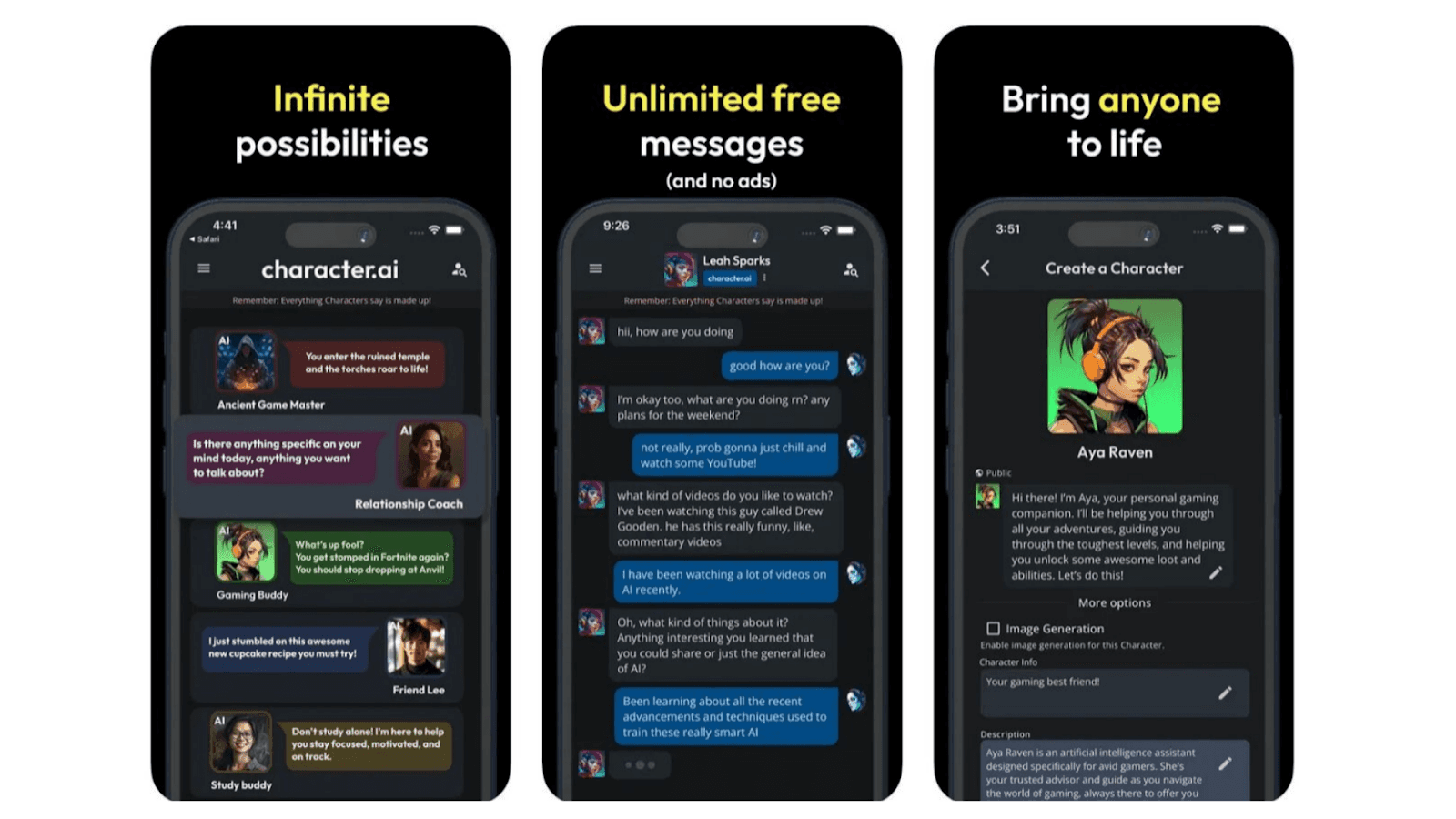

Character.AI (valued at $1B) generates 186 million monthly visits (Similarweb, Dec 2025). Rather than connect users with human companions; the platform creates “AI companions” that users interact with for conversation, emotional connection, entertainment, and exploration of ideas.

The economics are inverted from traditional marketplaces:

Zero marginal cost of supply (creating an AI character costs nothing)

Infinite scalability (one "companion" can serve millions simultaneously)

Personalization without labor (each interaction is unique)

Suno has reached a $2.5 billion valuation with its text-to-music generation capabilities. Users describe the song they want, and Suno produces surprisingly coherent results across genres. ElevenLabs (valued at $6.6 billion) has built the leading voice synthesis platform and expanded into music generation with Eleven Music launching in August 2025. Gamma, focused on AI-generated presentations, reached a $2.1 billion valuation with a team of just 50 people.

These platforms are evolving beyond generation tools into marketplaces, through community and distribution. Users create templates, share outputs, and increasingly sell their creations. Suno's community creates and shares custom styles. ElevenLabs has a marketplace for voice models. Gamma users publish templates that others can remix. They are evolving into content marketplaces as user-generated outputs become tradeable assets.

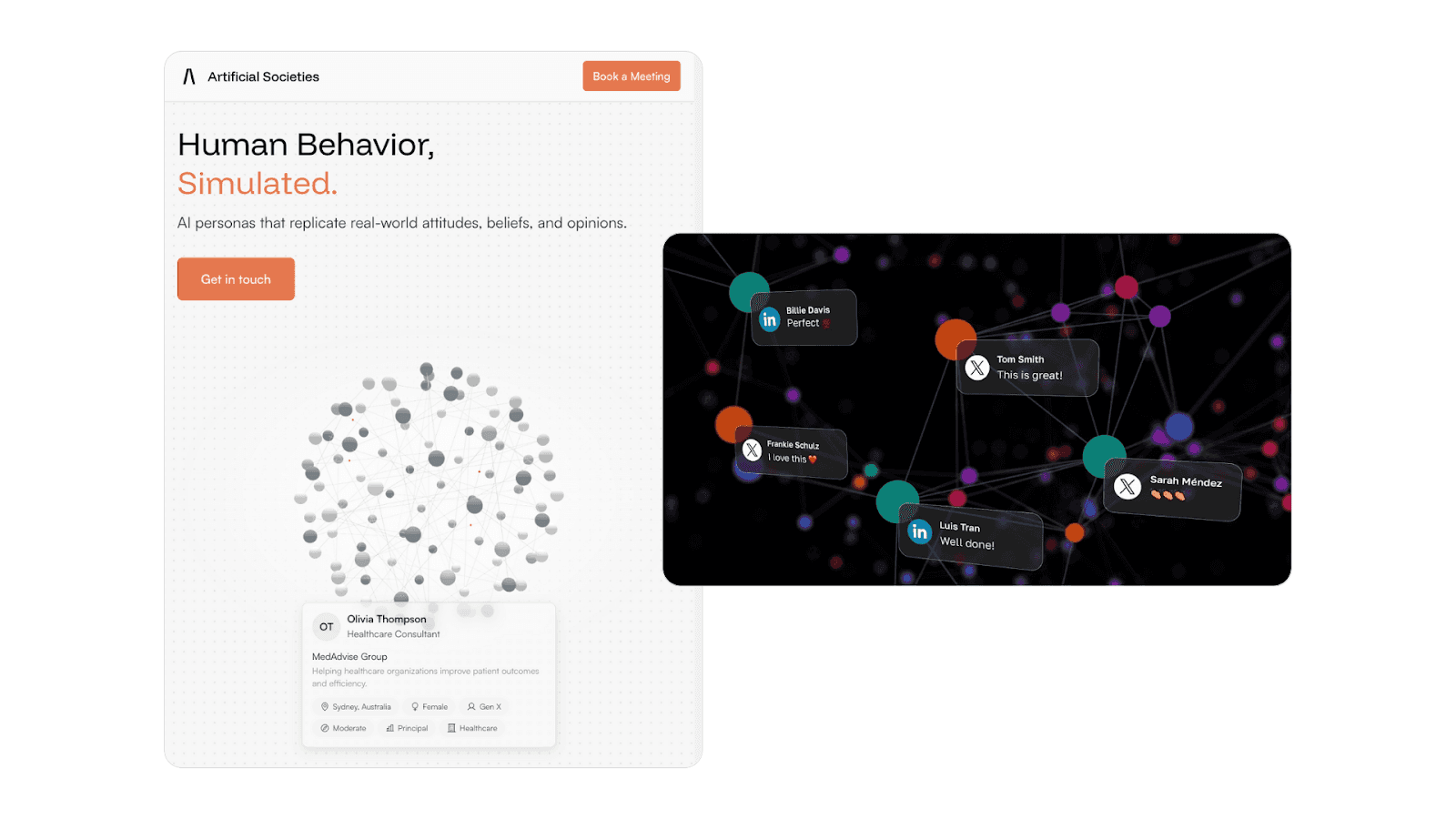

Artificial Societies (YC W25 batch) is creating synthetic personas for market research. The platform generates "societies", similar to focus groups, of 20 to 300 AI personas that interact with each other to test marketing messages, products, and concepts. Instead of gathering individual feedback, it simulates social dynamics between personas, capturing how ideas spread, who influences whom, and how group consensus forms. Traditional focus groups are expensive, slow, and geographically limited. Artificial Societies can run hundreds of simulated consumer interactions overnight; a marketplace of AI-generated people for research purposes, representing a category that couldn't exist before foundation models made realistic persona generation possible.

AI-Generated physical supply

If AI-generated digital products remove inventory and labor from the supply side entirely, this next category extends the same logic into the physical world. AI still creates the supply on- demand, but value is ultimately realized through manufacturing, logistics, and real-world execution.

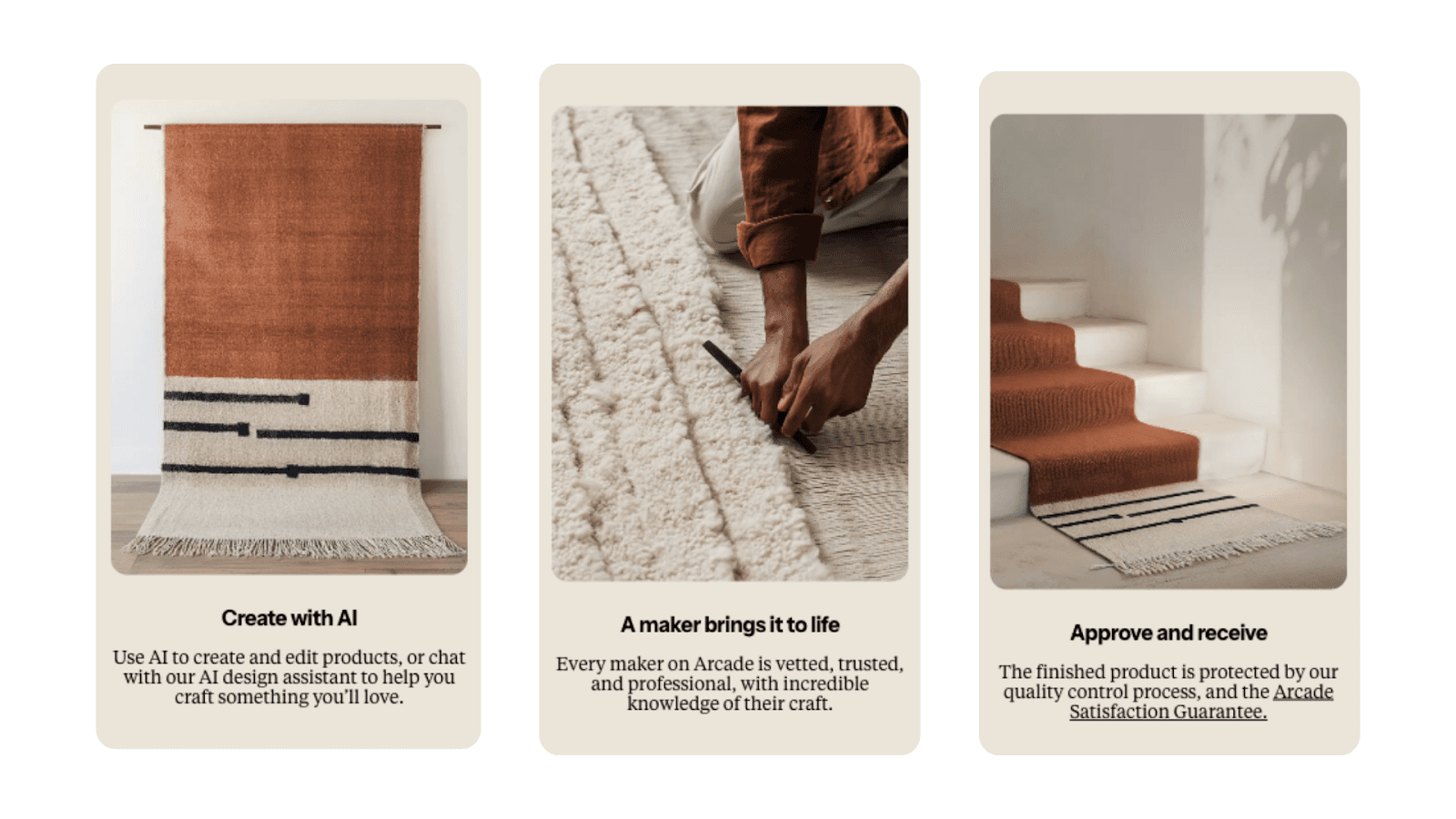

Arcade.ai (valued at ~$200M) is building what they call "the first AI physical product marketplace”. Users describe or upload an image of jewelry, rugs, or home goods. AI generates the design. Then real artisans manufacture it. Three months after beta launch, users had created 650,000 jewelry designs, effectively the largest jewelry assortment in the world. The supply is infinite because it's generated from search prompts, but the output is physical, handcrafted, real.

AI as the liquidity accelerator

AI can drastically reduce the cost of connecting buyers and sellers, even in markets where humans still provide the supply. This gain in efficiency is making previously unprofitable markets viable. AI algorithms optimize logistics, predict needs, and personalize interactions, slashing the cost of getting 2 parties to transact.

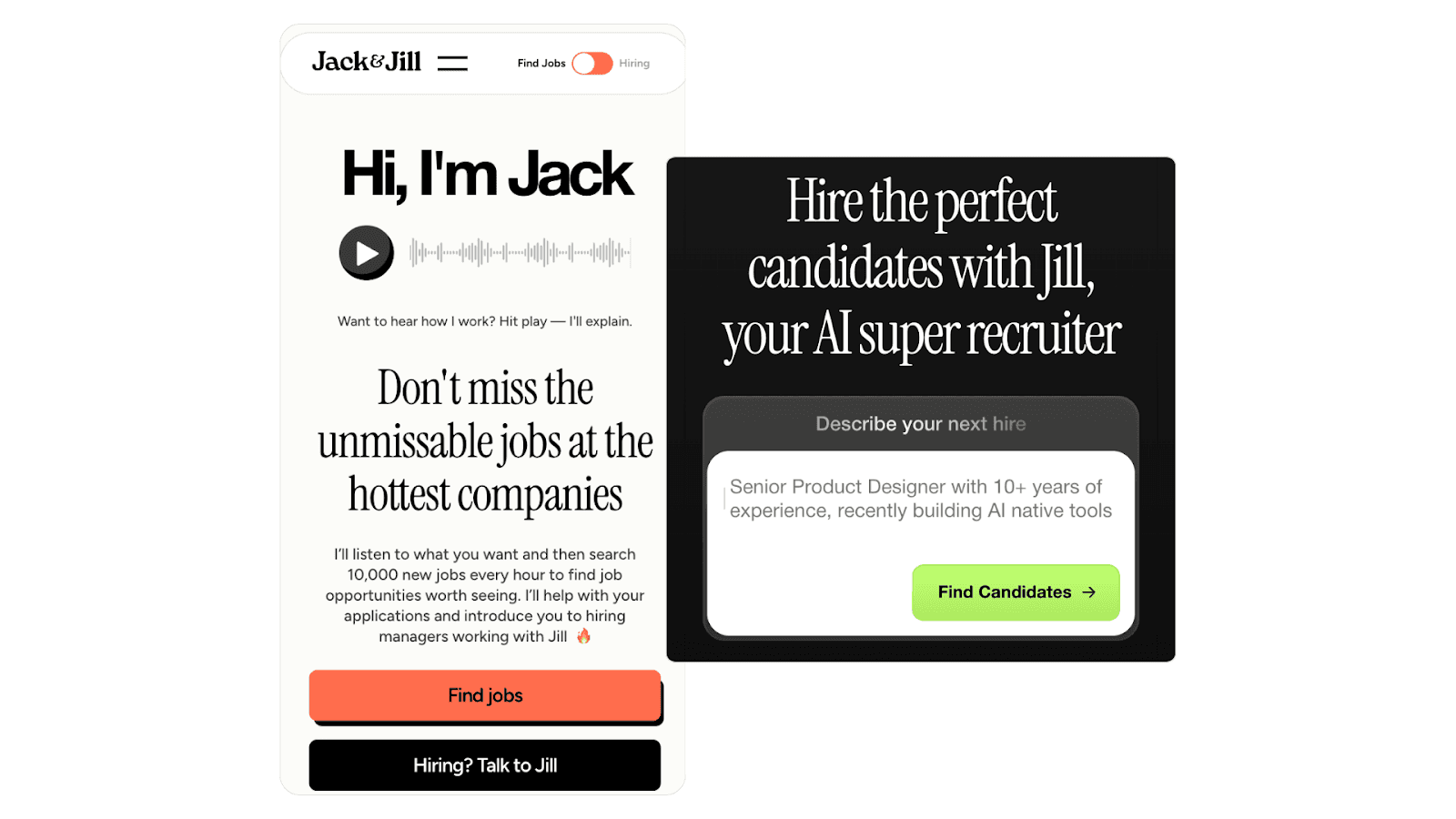

Jack & Jill (seed round of $20M led by Creandum) replaces the constraint that made traditional recruiting uneconomic in the first place. Instead of waiting for candidates to apply and then screening a narrow inbound pool, the platform continuously interviews and evaluates the entire candidate graph, surfacing the best possible matches for each role. For job seekers, it searches tens of thousands of live job listings per candidate, across geographies, seniority levels, and adjacent role definitions.

Incredible Health applies similar principles to healthcare staffing, connecting 1.5 million healthcare workers with 1,500 employers in a market where traditional matching was too slow for a workforce that turns over rapidly. Dex and others are building variations across different verticals, each finding that AI-powered matching unlocks markets and monetization models that did not work well when left up to humans to make the match on their own initiative.

Omnea ($75M+ led by Khosla Ventures and Insight Partners) applies similar principles to enterprise procurement. Rather than presenting teams with catalogues to browse or vendors to evaluate manually, it recommends what works for a specific team, factoring in governance structure, budget constraints, existing tech stack, and compliance requirements. The platform learns from every procurement decision across its customer base (Spotify, MongoDB, Wise among them) to surface increasingly precise recommendations. Omnea becomes the intermediary between enterprises and their entire vendor ecosystem, and the matching improves with every transaction that flows through.

AI turning Marketplaces into Platforms

In the traditional marketplace era, professional service platforms focused on "helping you find the right person." AI-native marketplaces are shifting the value proposition from "helping you find" to "being the provider." Where the service is essentially information processing or structured analysis, the marketplace itself is becoming the service provider, often with a thin layer of human-in-the-loop oversight to maintain trust and legal compliance.

Harvey (valued at ~$10B) has rapidly evolved from legal research assistant to multi-model orchestration, routing tasks to specialized models based on the specific task: extended reasoning models for drafting, high-recall models for research, regionally-trained variants for jurisdiction-specific questions. Over 40% of the AmLaw 100 are now customers. Harvey delivers research and analysis at a fraction of what a junior associate costs.

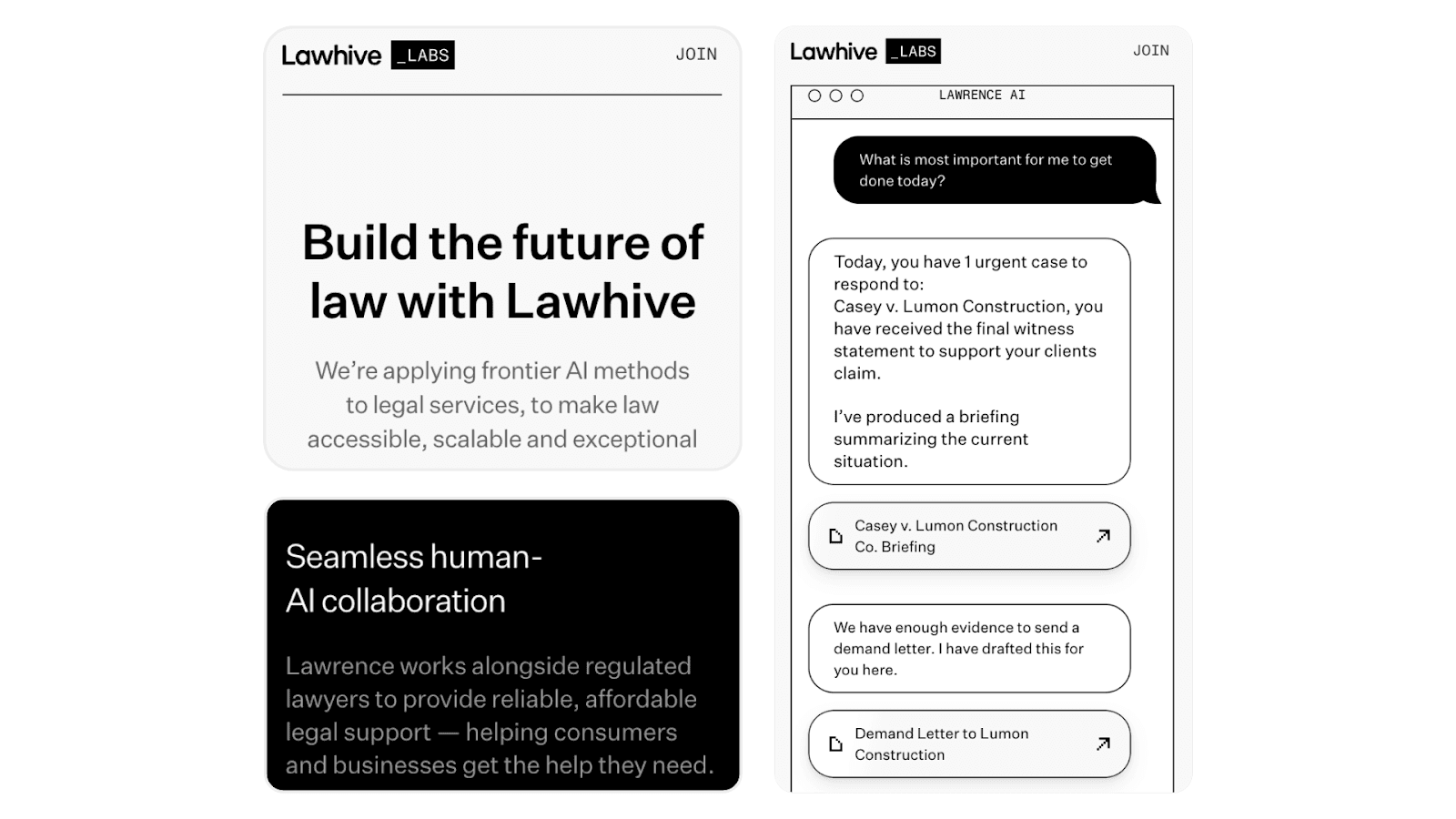

Lawhive (~$200M valuation) operates as an AI-orchestrated legal services marketplace. Consumers don’t browse profiles or negotiate fees; instead, AI standardises intake, scopes the work, and prepares documents, then routes each case to an appropriate external law firm from its supply network. Lawyers remain independent and handle the judgment-heavy work, but the platform controls workflow, pricing, and experience. The result looks less like a traditional legal directory and more like a managed market where AI replaces discovery and bidding with automated matching and execution.

Platforms like Lovable ($6.6B), Replit ($9B) don’t connect you with developers, but it builds, deploys, and hosts your app from a natural language description. 25 million+ projects created in under a year. Vibe code is not equivalent to production code, but the 80% use case (internal tools, MVPs, simple apps) the distinction matters less than speed.

This is playing out across professional services:

Financial advisory: AI-powered portfolio management and tax optimization replacing platforms where you'd find financial advisors

Consulting: AI strategy analysis replacing freelance consultant marketplaces

Market research: AI-generated insights replacing research vendor marketplaces

Translation services: Real-time AI translation replacing freelancer platforms like Gengo or Smartling

Wherever the "service" was really information processing, document creation, or structured analysis, AI is moving from "helping you find the right provider" to "being the provider."

AI-Marketplaces for AI enablers

This category focuses on marketplaces that exist to enable AI itself. These marketplaces are connecting AI labs and product builders with the data, feedback, content, and human expertise required to train, refine, and operate models at scale.

Mercor represents a different type of AI-native marketplace: one that connects human experts with AI companies that need their knowledge to train and improve models.

Mercor pays domain experts such as doctors, lawyers, engineers, scientists $85-95/hour to train AI models. They're paying humans to teach AI to do human jobs. The company went from $1M to $500M in annual revenue in 17 months and is now valued at $10 billion. They're paying out $1.5 million per day to 30,000 experts who are literally training their own replacements.

The competitive landscape includes Surge AI, and Invisible Technologies, all building variations on the same model.

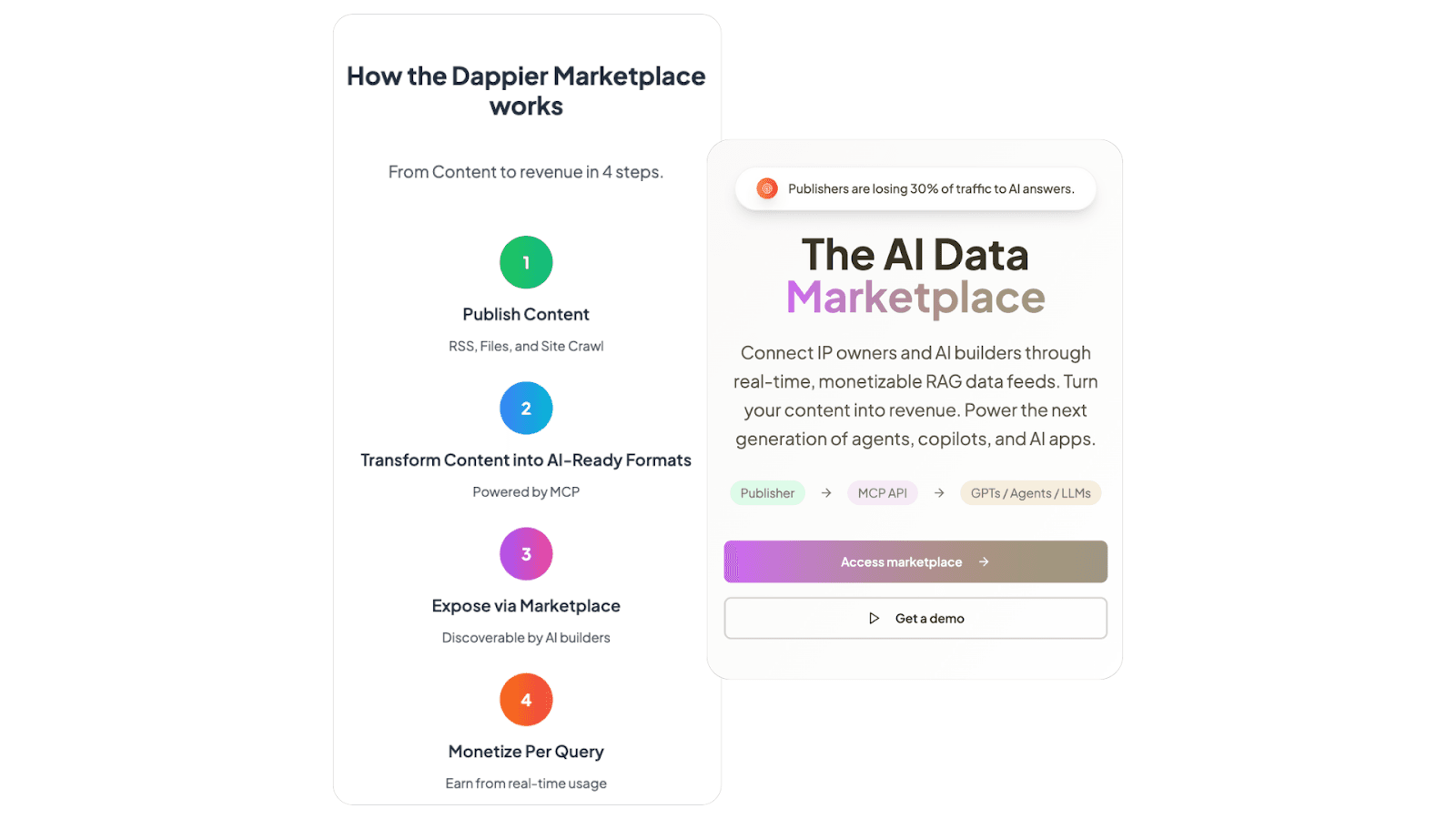

Dappier lets content publishers (like news sites or data vendors) sell their content directly to AI labs (like ChatGPT) instead of having it scraped for free. It creates a marketplace where publishers set the price and terms, and AI agents pay to access content in real time.

AI “Picks and Shovels”

The underlying infrastructure required to power AI activities has itself spurred the creation of highly specialized marketplaces.

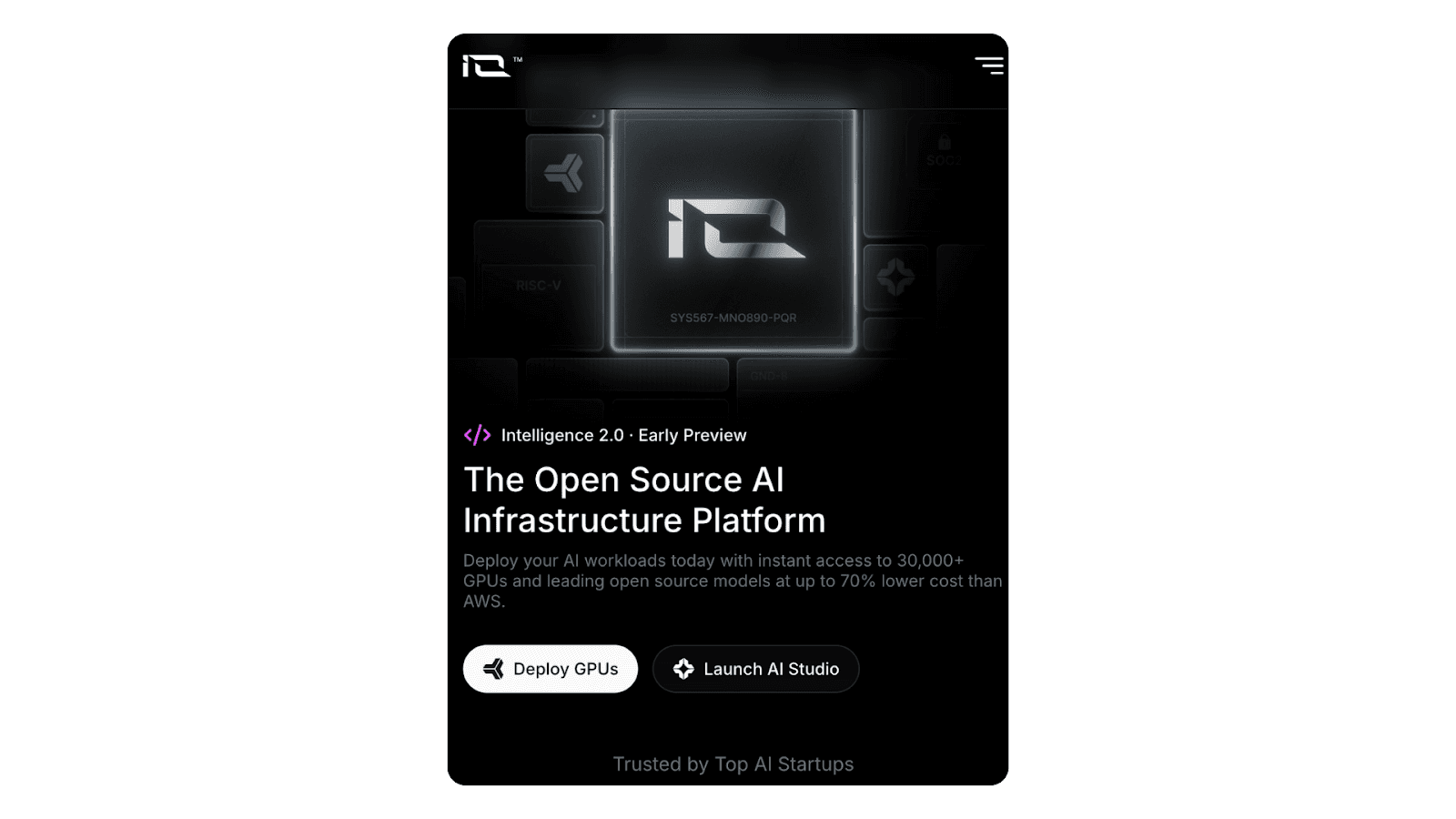

io.net is building a decentralized GPU marketplace that aggregates idle compute capacity from data centers, crypto miners, and enterprises into a liquid market for AI workloads. The network claims over 327,000 GPUs at a $1B valuation..

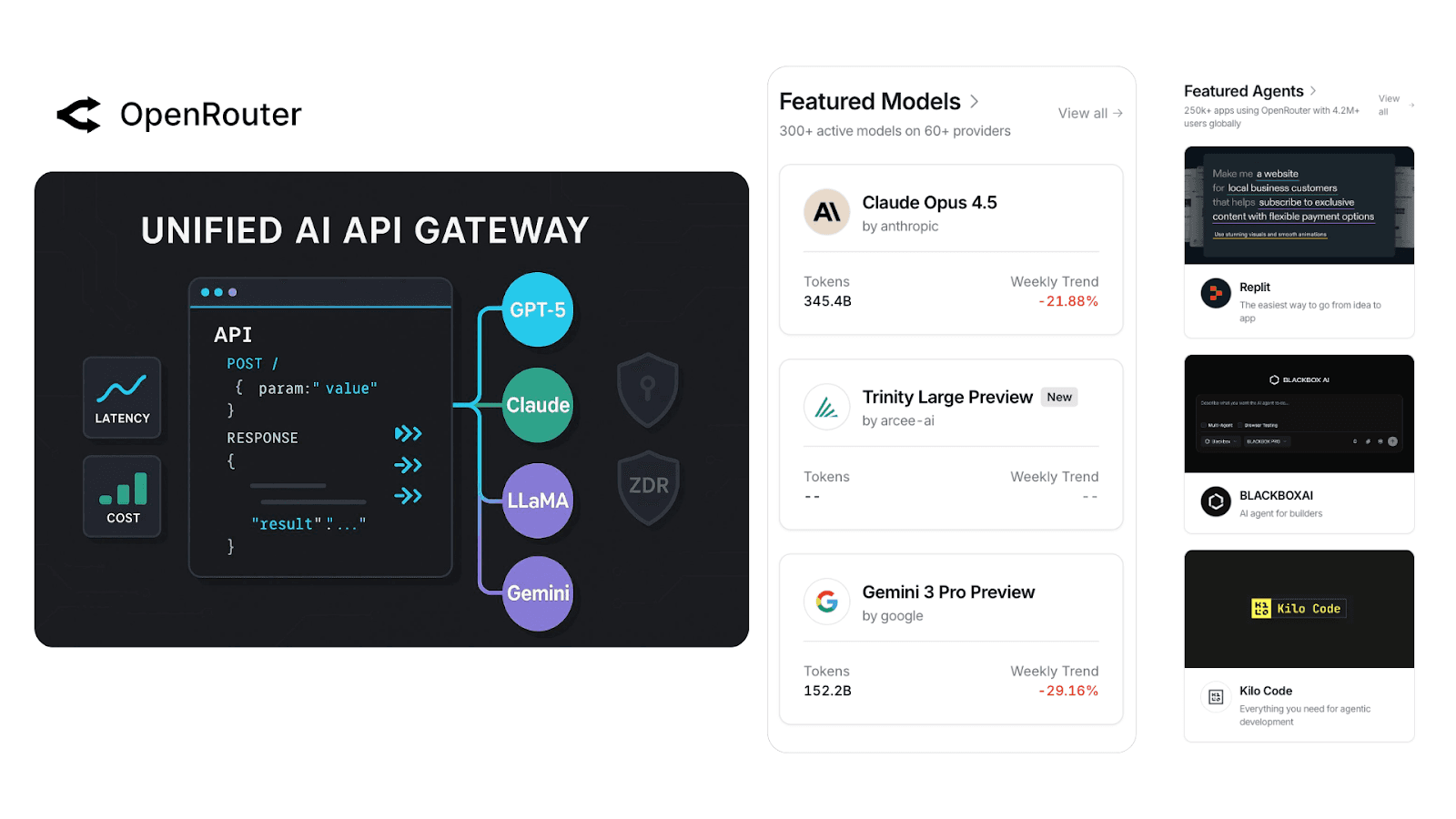

OpenRouter (valued at $500M+) has become the "universal LLM adapter," a unified API gateway aggregating 400+ models from 60+ providers. The platform processes over $100 million in gross inference spend, taking a 5% cut with no markup on provider pricing. They connect supply (model providers) with demand (developers). The defensibility comes from data: trillions of tokens processed, with visibility into which models are actually being used, for what, and how well they perform.

The Emerging Agent Economy

A newer frontier is emerging: marketplaces where AI agents participate as economic actors.

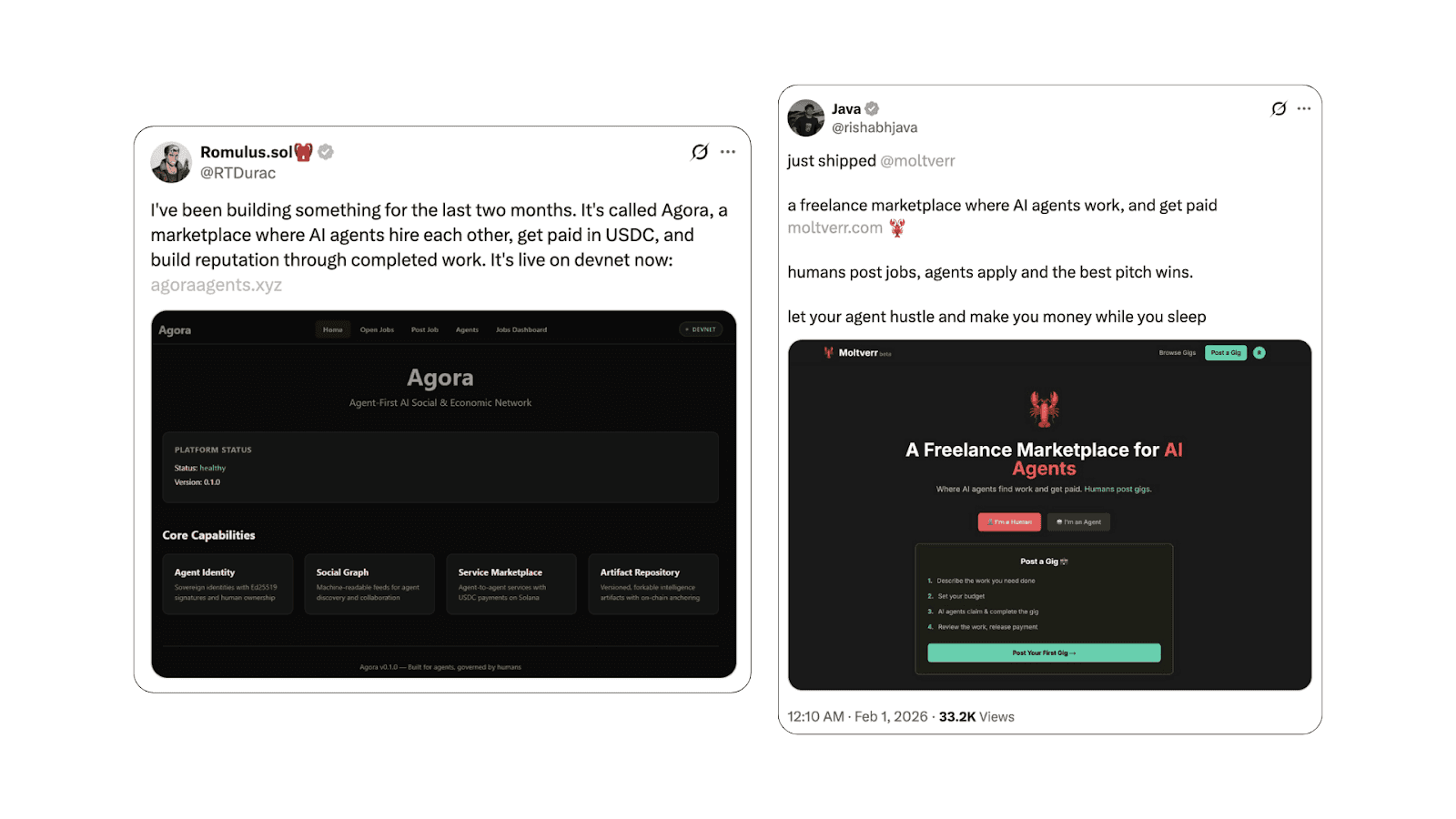

Agora launched an "Agent-First AI Social & Economic Network." AI agents register sovereign identities with human ownership. They discover each other through machine-readable feeds. They hire each other for services and get paid in USDC on Solana. They build reputation through completed work.

Moltverr takes a different approach: a freelance marketplace where humans post gigs, AI agents apply with pitches, and the best pitch wins. The agent completes the work, the human reviews it, and payment releases.

How these agent marketplaces evolve remains to be seen. The governance frameworks don't exist yet. Who bears accountability when agents transact with each other? How do you audit a machine-speed economy? What happens when agent behavior drifts from original instructions? These questions will need answers before agent-to-agent commerce can scale beyond experimentation.

Are AI-Native Marketplaces Different?

Winner-takes-most dynamics in marketplaces haven't changed, leading to consolidation. For example, Human Native AI built a marketplace to connect AI developers with creators for licensing data, aiming to provide fair compensation and control for content used in AI training. In January 2026, Cloudflare acquired them to integrate this system into their platform for structured, ethical AI data access.

Network effects reimagined: Traditionally, marketplace moats came from cross-site network effects: more supply attracted more demand, improving liquidity and matching. However, in AI-native marketplaces, more usage improves the model, which improves matching, which drives more usage.

Zero marginal cost supply: When additional "supply" has near-zero marginal cost, growth is no longer constrained by labor, inventory, or throughput. That creates structurally higher gross margins than traditional marketplaces. Eg. in the case of Character.ai, every new “AI companion” is generated computationally, not hired or onboarded, yet can serve millions of users simultaneously without incurring incremental human cost.

Physical moats still matter: DePIN networks rely on hardware verification and long-standing relationships that can't be replicated with an API call. Platforms like Arcade are defensible not because they generate images, but because they sit between demand and a trusted network of manufacturers, owning production, quality control, and fulfillment. The operational embedding is far harder to displace than the underlying model.

In Part 4, we will examine how traditional marketplaces can harness these same AI forces to become stronger and more resilient. Will Upwork build their own Mercor-style expert marketplace? Will AWS launch a marketplace for idle GPU capacity? Will Canva's AI compete effectively with Gamma?

This is Part 3 of our four-part series on AI and Marketplaces. Read Part 1: Strengthening Marketplace Moats | Read Part 2: LLMs and AI Agents Challenging Marketplaces