Jan 22, 2026

Marketplace moats in the age of AI.

Digital marketplaces have been built for humans. Designed around the limits of human attention they feature search boxes, filters, ranking algorithms, comparison tables, and carefully optimized funnels that nudge a user from curiosity to checkout. By aggregating and organizing fragmented supply better than anyone else, and presenting it through a superior interface, marketplaces have built enduring demand, justifying double digit take rates. Google, Booking.com, and Zillow built massive businesses by organizing the world's information and presenting it to human eyeballs. The value proposition became the moat.

But what happens in a world where discovery no longer needs to be mediated by human eyeballs? Large Language Models and autonomous agents are beginning to search, compare, and transact on a user’s behalf, often without ever visiting a marketplace’s homepage. In this world, the interface is not where value accrues, it is simply one possible point of access.

Which leads to the central question: “How defensible is the marketplace model when discovery and recommendation is being mediated between machines?”

AI does not challenge marketplaces uniformly; it targets specific functions, including discovery, comparison, decision-making, check out and dispatch. In doing so, it strips away value where marketplaces were acting primarily as UI wrappers, while simultaneously increasing the importance of trust, workflow orchestration, physical execution, and embedded supply relationships.

The more pertinent question, then, is not whether AI will disintermediate marketplaces, or render them less valuable, but which parts of the marketplace stack will AI disintermediate or disrupt, and how?

To answer this trillion dollar question, the impact of AI needs to be disaggregated, and nuanced between different types of digital marketplaces: between transactional and non -transactional marketplaces, between marketplaces for high value and low value items, and between marketplaces for physical goods versus services marketplaces.

What marketplaces excel at

Marketplaces emerged to reduce friction in fragmented buying and selling environments at scale. Historically, marketplaces solved for:

Search Costs & Discovery: Navigating millions of SKUs was impossible without a centralized hub that organized information for human eyes

Trust & Reputation: trust building through ratings, reviews, vetting, and escrow services replaced the need for strangers to conduct bilateral due diligence before transacting.

Price Discovery & Comparison: Aggregating options allowed users to find the best deals without "endless tab-switching" or high information asymmetry

Workflow and Transaction Handling: Seamless payments, logistics, and dispute resolution turned chaotic fragmentation into standardized convenience.

With LLMs and AI agents now offering search, recommendations, and comparisons, parts of this stack risk migrating away from the marketplace. Discovery can be replicated by a browser-based agent querying multiple suppliers in seconds, However, the remaining pillars, look harder to replace, especially in domains involving physical infrastructure or complex B2B logistics.

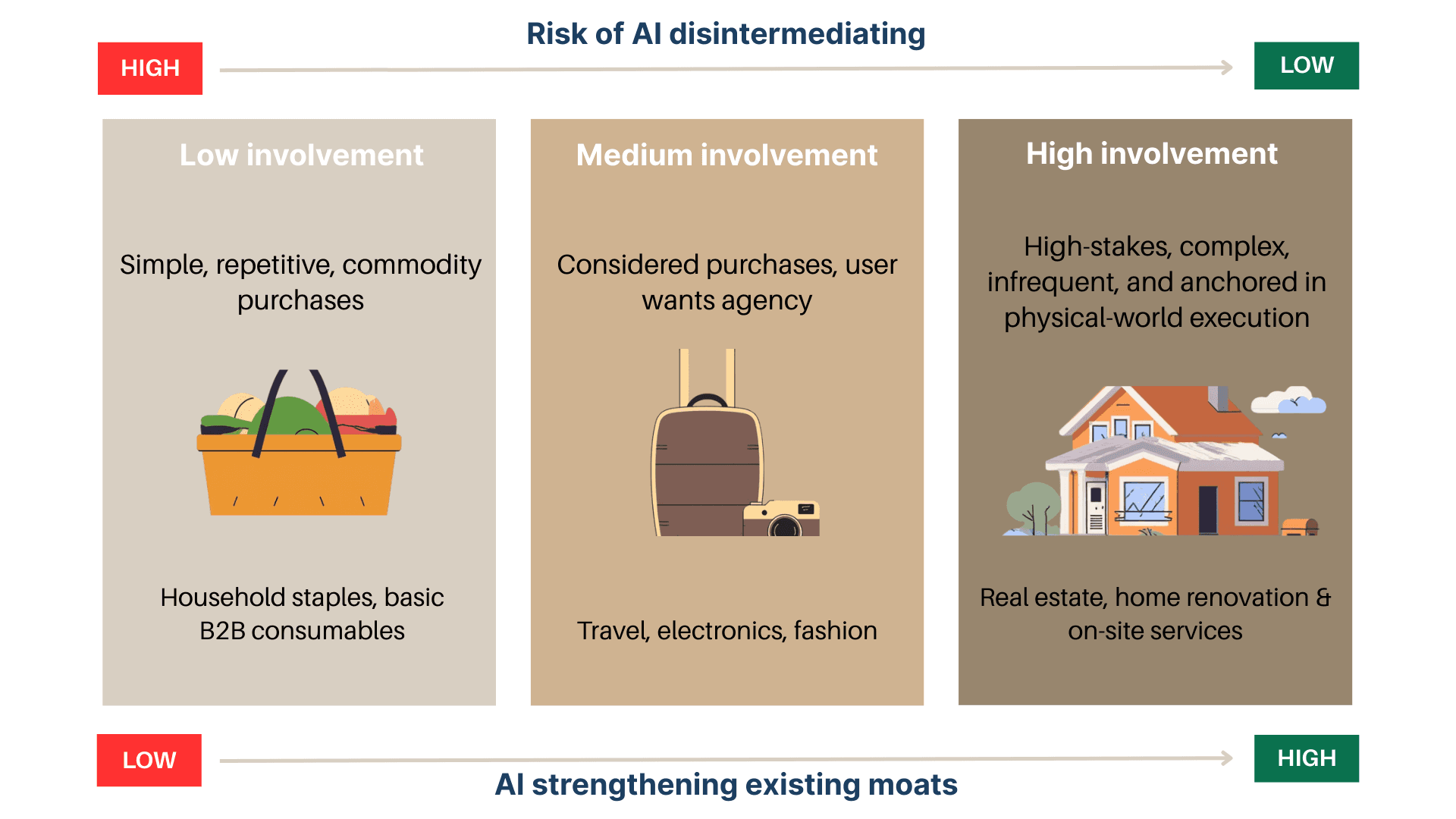

Levels of purchase involvement and complexity

We have created a simplified framework for illustrating marketplace disruption intensity seen with our 2026 optic, based on the level of "Purchase Involvement". This measures the degree of psychological, financial, and logistical challenge involved in a transaction.

Low involvement purchases

These are simple, frequently repeated purchases where the "joy of discovery" is near zero.

Examples include replenishing household staples (dishwasher tabs, milk) or basic B2B consumables (printing paper, coffee etc.). AI handles this effortlessly today. Agents can monitor usage and auto-order the cheapest option with limited or no human prompts.

Platforms that rely on a search UI for commodity goods risk high levels of disintermediation, at least from their more tech savvy buyers. Value add shifts to the physical world where the vendor that can guarantee delivery speed and reliability wins. Amazon and Instacart represent different ends of this risk; while Amazon thrives on its logistics moat, Instacart’s "UI wrapper" model is more vulnerable as grocers develop direct APIs for agents.

Medium involvement purchases

Considered purchases are categories where people still want to be involved, but less than before. Travel, electronics, fashion, freelance services. AI shortens the journey: fewer tabs, better suiting shortlists, less noise.

The agent acts as a sophisticated filter. It can summarize 500 reviews into three pros and cons and match specifications to a user’s specific context. Eg. plan a 5-day trip to Italy for a couple, mid-range hotels, good food, and a balance of sightseeing and downtime.

Here, marketplaces can still win where proprietary data drives more nuanced, optimized recommendations. An LLM might well generate attractive sounding options, but the marketplace knows the real-time availability, the ins and outs of the cancellation policy, and the specific "bundle" deals that aren't indexed on the open web. The user often ends up on the marketplace to do the final "sanity check" – “is this the best overall deal?” before committing several hundred or thousand euros.

High-involvement purchases

Here we refer to high-stakes, complex, and infrequent decisions: buying a car or home, or renting one for 3 years, hiring a legal firm for a merger, or selecting a multi-year B2B software vendor.

Here, AI currently seems best suited to provide decision support, not decision making. It can surface 10 homes that fit a lifestyle, but it cannot provide that sense of conviction that you have fully explored all the options, understood the tradeoffs, and found the very best one.

In high-stakes categories, the marketplace provides trust infrastructure. Over-simplified AI “recommendations” provided in bullet points verge on the dangerous here. The marketplace provides the specialized workflow (legal compliance, financing, professional vetting) that a general-purpose agent cannot readily replicate today. Disintermediation in this segment is much harder to pull off because the "cost of being wrong" is too high to delegate to a bot.

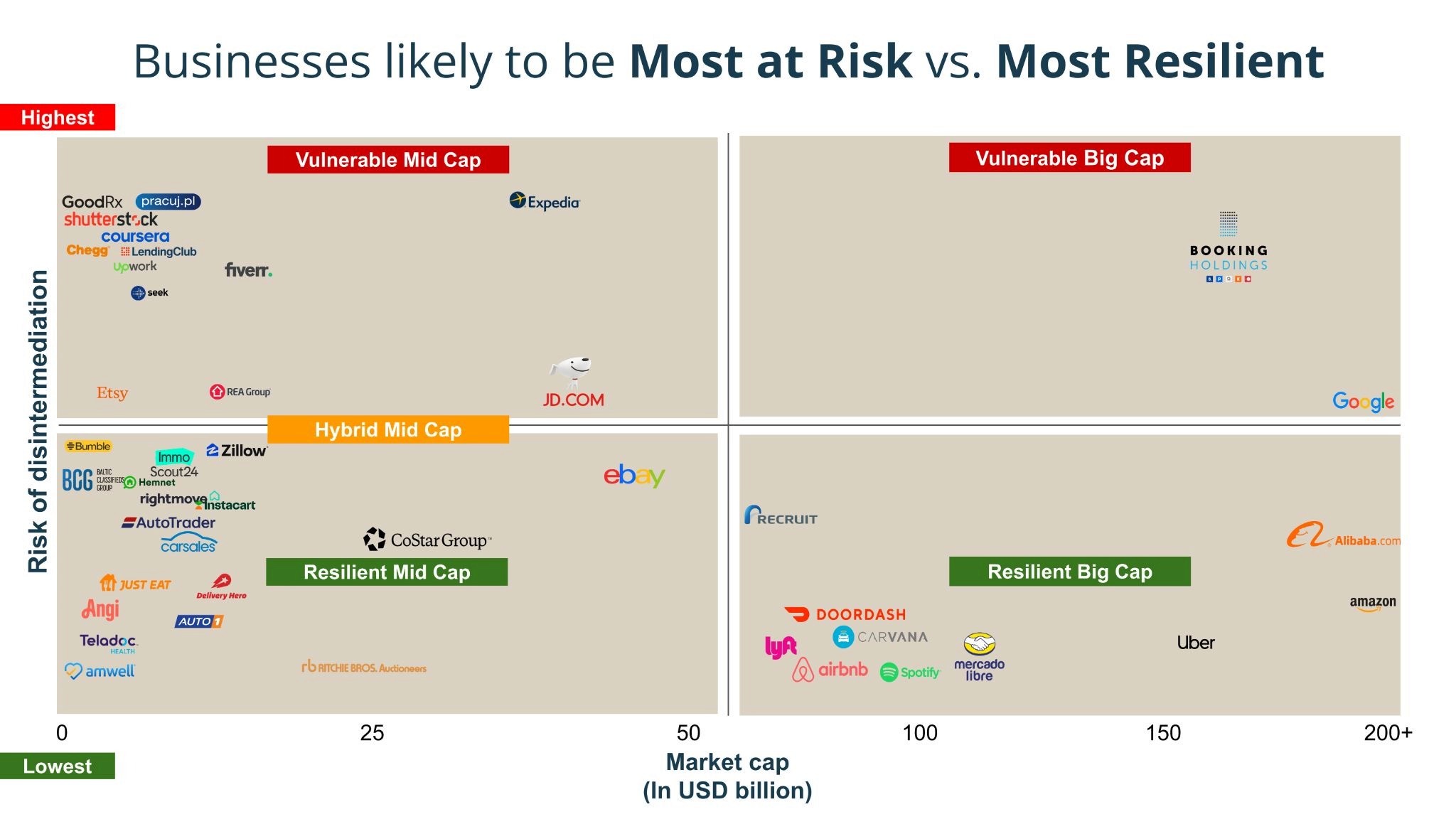

So who’s actually at risk?

Our chart is designed to spark debate. It should be seen as assessing where AI- related threats most clearly lie, before considering how marketplaces can themselves deploy AI to deflect or shake off these threats.

The Vulnerable quadrants: These are platforms that largely solve for "find me the cheapest X." Price comparison sites and some general classifieds sites are potentially most challenged. If their primary revenue is lead-gen based on simple search traffic, AI agents will likely capture that traffic before it ever reaches their site.

The hybrid zone: The Discovery Destinations. Platforms like Etsy or Pinterest-style marketplaces. They offer "inspiration" and "curation." While AI can replicate some curation, the "human" element and the specific community-driven supply provide a defensive buffer. However, they must adapt their front-ends to be more conversational and agent-friendly.

The most resilient quadrants: a) high involvement goods and services marketplaces plus

the Workflow Orchestrators. The latter are marketplaces deeply embedded in the operations of the buyer or seller. Think of B2B platforms that manage the entire procurement-to-pay cycle, or logistics-intensive players that own the physical fulfillment. Their moat is not Discovery; it is Execution.

Beyond "agents dis-intermediate marketplaces"

The narrative that agents will make marketplaces invisible infrastructure is compelling for certain use cases, but it ignores several fundamental truths about human psychology and market mechanics.

Choice and self-expression still matter

The "Zero-Click" future assumes consumers want to delegate everything. After 20 years of Google Maps, we still often want to choose which route to take. For many categories, the process of choosing is part of the value. Whether it’s fashion, home decor, or even a specific brand of artisanal coffee, consumers value curation and the ability to discover something "unexpected." An AI agent optimized for "efficiency" might miss the novelty that keeps users coming back to a platform like Etsy, The Luxury Closet, or Remix.

Hybrid journeys are the new normal

We do not expect the journey to move 100% to agents. Instead, we see "Hybrid Journeys." A user might start a search in an LLM (e.g., "I need a flat in Berlin near a park for under €2k per month"). The LLM surfaces three listings from a marketplace like Immoscout24. The user then clicks through to the marketplace to view the high-resolution photos, check the verified landlord status, and use the platform's messaging tool. The marketplace remains the "Trust Anchor" and the "Transaction Venue," even if it loses the initial "Discovery" click. Marketplaces will also become increasingly adept at using logging in to unlock higher value features. Logged in users can then be nurtured in a highly personalized manner for future interactions.

Monetization and ownership

Even if discovery starts elsewhere, the economics of the transaction (leads, commissions, insurance, financing) often stay with the marketplace that at least today very much still owns the supply-side relationship. The strategic imperative for marketplaces is to make their data machine-legible (via APIs and protocols like MCP) so that when an agent is looking for a solution, the marketplace is the obvious partner to call.

The Road Ahead

This blog is the first of a four-part series that examines how AI is reshaping marketplaces. We will continue over the next 3 weeks with:

LLMs as meta-marketplaces: how a new, agent-driven search layer reroutes traffic, compresses traditional funnels, and shifts acquisition from keyword-led SEO to experience-first discovery.

AI-native marketplaces: emerging models built around AI-first matching, dynamic supply generation, and adaptive pricing systems that were structurally impossible before 2024.

The incumbent playbook: a strategic and tactical view of how existing platforms can deploy AI to delight customers and deepen moats across acquisition, pricing power, and operational execution.