Why are Property Portals such great businesses?

- Malcolm Myers

- Sep 17

- 5 min read

Updated: Sep 24

The Unsung Heroes of Tech Investing

At first glance, online property portals look dull. They are not flashy consumer apps, nor are they deep-tech ventures. They are classified ad sites for homes. The term “classifieds” has its roots in the era of newspapers, when items for sale were classified by category. Yet behind this veneer of simplicity lies one of the most lucrative and defensible business models in the digital economy. Property portals such as Rightmove in the UK, Hemnet in Sweden, and ImmoScout24 in Germany have quietly compounded extraordinary shareholder returns for decades. Their secret? A blend of network effects, pricing power, and resilience that few business models can rival.

The Common Blueprint: Why Portals Win

At their core, property portals thrive on a two-sided network effect. Buyers congregate on the site with the most listings, while sellers (agents, developers, or homeowners) want to list where the buyers are. This self-reinforcing loop creates a liquidity density that is defensible not just at the national level but usually within every local micro-market. Once one platform establishes dominance, it becomes the de facto “digital utility” for property search. Brand, consumer habit, and the power of data compound to create a fortress.

This chart captures the flywheel effect that sits at the heart of every successful property portal: more agents drive more listings, which attracts more buyers, which in turn makes the platform indispensable for agents.

Rightmove: The Masterclass in Network Effects

Rightmove is the definitive case study in network effects. By 2024, over 80% of all time spent on UK property portals was on Rightmove. The company delivered more than 7 of every 10 vendor instructions and 8 of every 10 lettings leads generated by UK portals. For estate agents, being absent from Rightmove is not an option. It is arguably akin to running a shop without a sign.

This dominance translates into pricing power. Average revenue per advertiser (ARPA) rose to £1,524 per month for estate agents in 2024, and £1,987 for developers. Agents grumble about costs, but churn remains vanishingly low at around 90% renewals. The economics are exceptional: approximately 70% operating margins, recurring revenues, and near-total cash conversion. Even downturns do not break the model. When transactions fall, agents need leads even more.

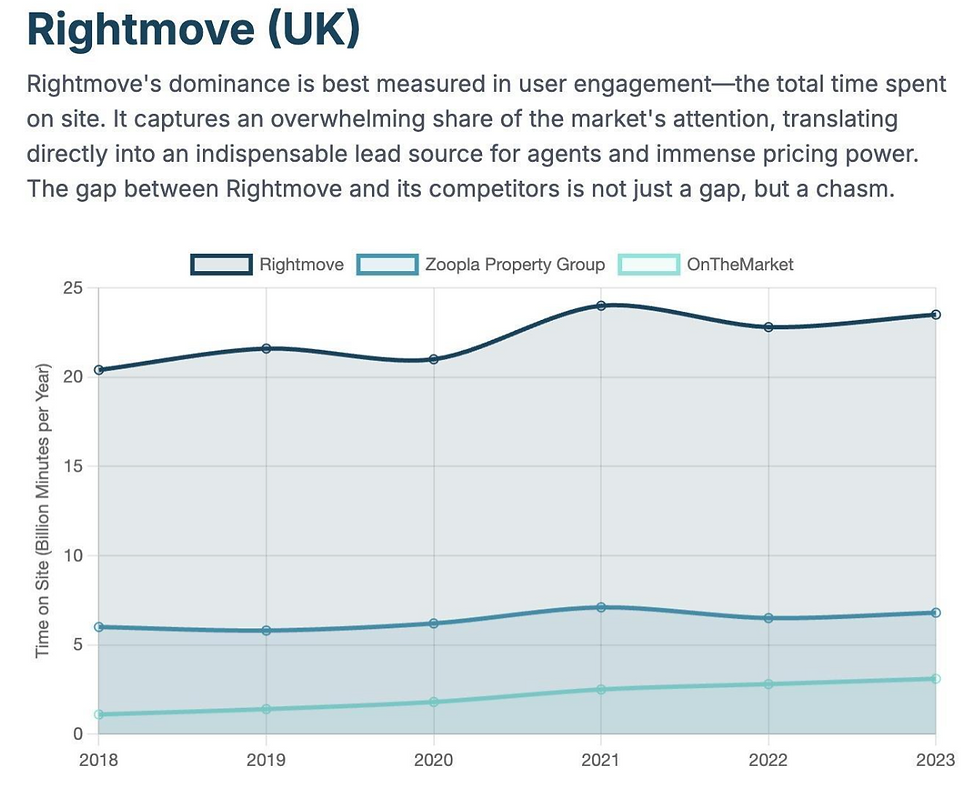

Importantly, this dominance has survived waves of threats. This chart highlights the Relative Market Share gap. Rightmove attracts multiple times more consumer time and traffic compared to Zoopla and OnTheMarket, underlining why rivals struggle to dent its position. Zoopla became a solid number two by acquiring 5 smaller property portals (2007-12), while OnTheMarket was launched by agencies specifically to provide a lower cost alternative. Even after spending £46M on advertising in 2024 - about 3x the level of Rightmove, it is hard to perceive a dent in Rightmove’s growth trajectory. Consumers still turn to Rightmove first because it has the most complete set of listings, and agents cannot afford to be absent from the place where most buyers are looking.

Rightmove’s profitability far exceeds even SaaS benchmarks, showing the structural advantage of property portals.

Hemnet: The Genius of the Vendor-Pays Model

In Sweden, Hemnet perfected the portal playbook by tweaking the monetization engine. Instead of charging agents subscriptions, Hemnet charges sellers directly for marketing packages. This reframing transforms the economics. A homeowner making the single largest financial decision of their life is far less price-sensitive than an agent paying recurring fees. Spending a few thousand SEK more on marketing is trivial if it can drive a higher selling price.

Hemnet took it further by co-opting agents into the process. For every package a seller buys, the agent earns a commission. The result: the nation’s entire agent network became Hemnet’s distributed salesforce. Unsurprisingly, adoption is near-total: 86% to 90% of all homes sold in Sweden are listed on Hemnet, and traffic is 10 to 20 times larger than its nearest competitor.

This model unlocked extraordinary pricing power. Average Revenue Per Listing (ARPL) climbed from SEK 1,760 in 2020 to over SEK 8,451 in 2025. Even during the Swedish housing downturn of 2022–23, Hemnet’s revenues kept rising. The platform has effectively decoupled from housing cycles. Its growth is driven by product tiers and pricing strategy, not transaction volumes.

This chart shows Hemnet’s overwhelming lead in Sweden, with traffic often 10 to 20 times larger than Blocket’s property vertical. This attention advantage has made Hemnet indispensable. Blocket Bostad, backed by Schibsted, tried to leverage its strong horizontal classifieds presence to compete. Despite significant resources and brand recognition, it failed to displace Hemnet because users seeking property prefer the depth and liquidity of a specialist portal. Regulators even blocked a potential Blocket acquisition of Hemnet, cementing Hemnet’s role as the goto platform.

ImmoScout24: From Marketplace to Digital “Utility”

Germany’s ImmoScout24 illustrates a different take on the model: expanding it beyond B2B. With around 20 million monthly users, it dominates the German market. But unlike many peers, ImmoScout24 monetizes not just agents and developers but also consumers. Products like SuchenPlus für Miete (renters) offer paying subscribers early access to listings and preferential visibility; a highly valued service in supply-constrained rentals markets.

These services produce higher-quality leads, which in turn justify higher fees for agents, creating a flywheel within the flywheel.

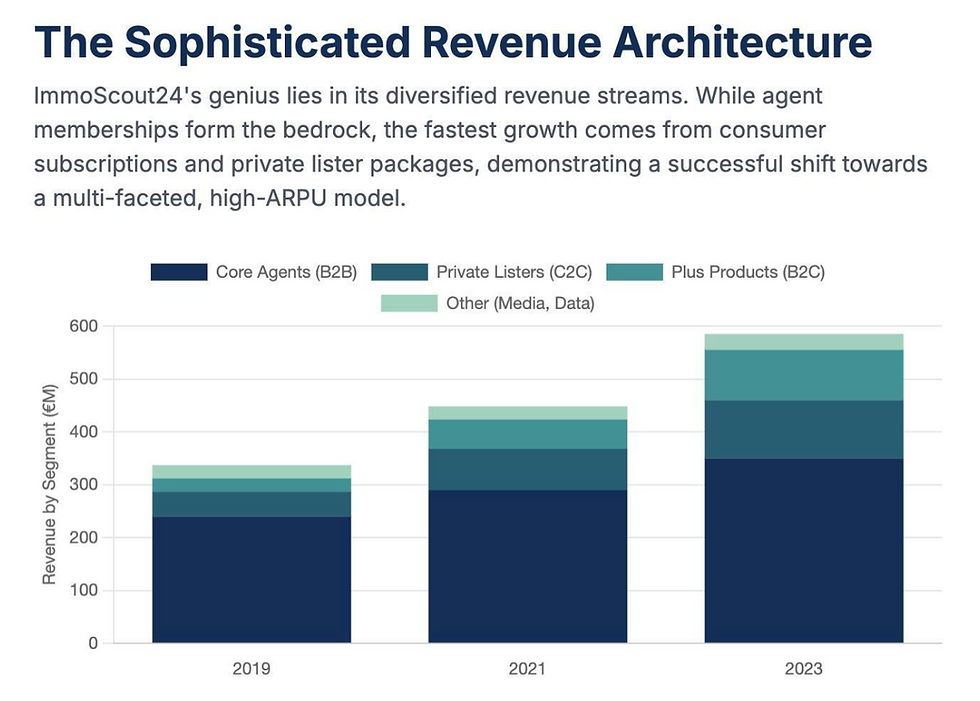

This B2C expansion has created a diversified, high-margin revenue mix: subscriptions for agents, fees for private listers, consumer subscriptions, mortgage lead generation, and advertising. EBITDA Margins north of 60% make ImmoScout24 one of the most profitable digital businesses in Europe. Crucially, it has outpaced the relatively flat German housing market by consistently innovating on monetization rather than relying on asset inflation.

ImmoScout24’s multi-pronged revenue mix shows how B2C products are now a key driver of growth.

Why These Are “Dream” Businesses

The property portal model is one of the clearest examples of a digital fortress:

Resilience: Subscription-like revenues hold through cycles. Downturns often reinforce the need for leads.

Scalability: Asset-light, high operating leverage. Incremental revenues flow to profit.

Pricing Power: Ability to raise fees far above inflation with minimal churn.

Moat: Entrenched network effects, proprietary data, and ingrained consumer habits.

Optionality: Expansion into depth ad products, data analytics, CRM, mortgages, and insurance.

Rightmove, Hemnet, and ImmoScout24 show that the formula works across markets with different structures. Each has compounded shareholder value at rates that rival the best SaaS companies, without the same competitive fragility.

Conclusion: The Digital Fortresses

In an era when many digital businesses face relentless disruption, property portals stand out as remarkably durable. They are, in essence, utilities: indispensable, high-margin, and nearly impossible to replace. Their strength lies not in novelty but in inevitability. And for investors, that is precisely what makes them beautiful.

The most enduring digital businesses are not always the most exciting at first glance. Sometimes, the real jewels are the quiet giants: the platforms that become so embedded in daily economic life that they transform from businesses into infrastructure. Property portals are that rare breed, a near-perfect digital business model, built to last.

Next week I will take a closer look at the challenges to leading property portals from the likes of Google and Facebook, before setting the scene for how AI opens up new ways to challenge leading property portals.